Capitalism Works

- Capital seeks the highest returns possible: High profits attract competition.

- So…most businesses with high returns on capital will see returns decrease over time.

Moat Basics

-

Economic moats are structural & sustainable qualities that are inherent to the business.

- Not hot products. (Heelys? Krispy Kreme?Sugar is a moat)

- Not just a cool piece of tech (lomega?In tech there will be a newer with more advanced product)

- Not the biggest market share (GM? Compaq?)

-

Moats generally manifest themselves in pricing power: A company that can’t raise prices is unlikely to have a strong moat.

INFO: We looked at companies that maintained Return on Capital above Cost of Capital for 15+ years.

- What are the common characteristics of these business

- Whats the similarities in these business

Intangible Assets

-

Brands

- Increase willingness to pay / lower search costs

- Sony(Tech product:who buys VCD Players) vs. Tiffany(Diamonds, its worth it)

- Amazon, Groupe Richemont, Coca Cola İçecek

- Increase willingness to pay / lower search costs

-

Patents

-

Legal monopoly vs. expiry/challenge/piracy

- If one drug is driving all the economic value, if that patent is getting challenged, you are dead. So, you have to be very careful.

- Novo Nordisk, Qualcomm, Chr. Hansen

-

Licenses/ Approvals

- Legal oligopoly vs. regulatory fiat

- Casinos(limited licenses), landfills(nobody likes to live there, less number licenses), aircraft parts(Most of the parts are made by one company, good business)

Widening the Moat: Brands

-

Brands are valuable if they deliver a consistent or aspirational experience.

- Consistency lowers search costs & drives loyalty. Don’t change & give people a reason to switch!

- Mistake: New Coke, The Schlitz

- Consistency lowers search costs & drives loyalty. Don’t change & give people a reason to switch!

-

Aspiration increases willingness to pay. So, create scarcity & exclusivity. +Tiffany’s store layout(40% revenue comes from stuff that costs less than $200 and shop layout is like costly items in front and cheap at last) +“You don’t own a Patek Philippe, you merely take care of it for the next generation.”

Confidence is how other people see you.

Switching Costs

- Does the cost of switching to a competing product or service outweigh the benefits?

-

Integrate with customer’s business: Upfront costs of implementation payback from renewals

- Silverlake Axis, Oracle, SimCorp

- Migrating to Oracle to another database is a expensive thing for a multi-national company, they will not go for it. So, lock-in is a good thing.

-

Sell ongoing service relationships

- Rolls Royce, Otis, Kone, Schindler

- Kone is a elevator company, once a elevator is setup, its not coming out. Rolls Royce, sells JetEngine they change you by the hour. You pay is related to how much you use it.

-

Provide a product with a high benefit/cost ratio

- Fastenal(Makes bolts, product doesn’t cost much, but brings huge economic cost to the company), Ecolab, Novozymes, Fuchs Petrolub

- Lubricant which improves performance of a mining machine, that lubricant costs less when compared to the actual machine or production, so even if they increase 20%, they will pay for it.

-

The Network Effect

-

Provide a service that increases in value as the number of users expands.

-

Aggregate demand b/t fragmented parties.

- Edenred, Henry Schein(used by dentists), XPO Logistics

-

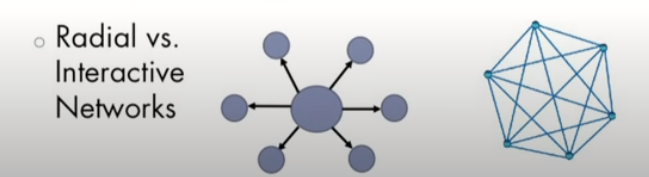

Non-linearity of nodes vs. connections.

- Visa, Mastercard, Facebook

-

-

Western Union is Radial, they have lots of branches but nobody is sending money from Bangladesh to Chicago or Mexico

Cost Advantages

-

Process: Invent a cheaper way to deliver a product that can’t be replicated quickly.

- Inditex, RyanAir, GEICO, Dell

-

Scale: Spread fixed costs over a large base. Relative size matters more than absolute size.

- UPS, Aggreko, Stericycle

-

Niche: Establish minimum efficient scale

What About Management?

- “Good jockeys will do well on good horses, but not on broken-down nags.” (Buffett)

Moats, Management & Mistakes

- Moats can buffer management mistakes

- Microsoft minted money despite Steve Ballmer

- New Coke didn’t kill Coca-Cola

- Moodys put profits before integrity, and still cranked out a 40% operating margin

- But even a genius like David Neeleman couldn’t change that fact that JetBlue is an airline - the worst industry known to mankind.

The Good & the Bad

-

Good managers are constantly looking for ways to widen a company’s moat

- Amazon’s focus on the customer experience(There is a lots of trust involved)

- Costco’s focus on using scale to lower costs

-

Bad managers invest capital outside a company’s moat, lowering overall ROIC

- This process is called “deworsification,” or “setting fire to large piles of cash.”

- Example Cisco — Starting a consumer business, Garmin — Starting a GPS Handset business(Every phone has GPS)

An Exception to Every Rule

-

A tiny minority of managers can create enormous value via astute capital allocation - even if they don’t start with great horses.

- Warren Buffett (Berkshire), Brian Joffe (Bidvest), Dick Kovacevich (Wells Fargo), Steve & Mitch Rales (Danaher)

-

They are hard to find, and false positives abound…but they can create enormous wealth over time. Keep an eye out!

Valuing Moats

-

The value of an economic moat is largely dependent on reinvestment opportunities

-

The ability to reinveset tons of cash at a high incremenetal ROIC = a very valuable moat.

- Fastenal, XPO, Curro

-

If a firm has limited ability to reinvest, the moat adds little to intrinsic value. +McCormick, Microsoft, Oracle

Isn’t Moat Already Priced In ?

- Moats usually matter in the long run than in short

- Most investors assume the current state of the world persists longer than it usually does.

Finding Moats = Finding Inefficiency

- Quantitative data is efficiently priced in

- Qualitative insight is less efficiently priced

Moats in a Global Context

-

Local differences create moats

- Canadian banks, Edenred, German car washes

-

Minimum efficient scale is more common South African retailers, Globo, BEC World

-

Cultural preferences create barriers to entry Beer travels. Candy & snacks generally don’t.