I wrote a book called * The most important thing * in 2011. The reason the book has that title because i would find myself in clients office and i would say the most important thing in investing is controlling risk and then 5 minutes later i would say the most important thing is to buy at low price and then 5 minutes later i would say the most important thing is to act as a contrarian.

In 2003, i wrote a memo called called * The Most Important Thing *. In there, i had listed 19 things, each of the things are most important things.

-

Investing is difficult, kind of, counter intuitive and kind of, turns back on itself all the time.

-

Personal philosophy comes from what you have taught by parents and teachers and your experiences. Experiences tell you what have been taught and have to be modified.

Below points are illustrate where the philosophy came from.

# Fooled by randomness - Nassim Nicholas Taleb

- It is either, the most important badly written book or worst written very important book you will ever read.

- Its not very clear, there no attempt to make it clear.

- In investing there are lot of randomness. Great returns does not mean he is a good investor, he would be a guy who took the crazy shot and got lucky.

- Read the book in 1963, “Decision making under uncertainity” by C. Jackson Greyson. There are couple of important points,

- You cant tell quality of a decision from an outcome whether a decision is good or bad. In real world, good decision fail to work all the time. Bad decisions work all the time. If good decision work all the time there would be no risk.

Improbable things happen all the time and probable things fail to happen all the time . If probable things happen all the time, there would be no risk.

Even if you know whats most likely, many other things can happen instead.

- You should not act as if the things that should happen are the things that will happen.

- In world of physics, its true. Electrical engineer knows if you switch on the light, light over there will turn ON. Everytime. This doesn’t work in investing.

- For every possible phenomenon, there are range of things that can happen. Its possible to discern which one is most likely. But that doesn’t mean its going to happen. Its very important to notice,

- There are lots of things that can happen. So you have to allow for them.

- The thing that is most likely to happen is far from sure to happen.

Simply to put,

Risk means more things can happen than will happen

—— Elroy Dimson

- In the economic world, people make decisions based on something called expected value.

- First don’t think in terms of single outcome, you think in range of outcomes. You take every possible outcome and multiply it by the likelihood that it will happen, you sum the results, and then you get something called the expected value from that course of action. You choose your course of action from the highest expected value. It sounds like the totally rationale thing.

Should is not equal to Will. Lots of things that should happen fail to happen. And even if they don’t fail to happen, they fail to happen on schedule.

—— Howard Marks

One of Howard Marks favourite sayings

Never forget the six foot tall man who drowned crossing the stream that was five feet deep on average.

We can’t live by the averages

- If you are a decision maker, you have to survive long enough for the correctness of your decision to become evidence. And you can’t count on it happening right away.

Overpriced is not same as going down tomorrow.

# John Kenneth Galbraith

We have two classes of forecasters: Those who don’t know — and those who don’t know they don’t know

—— John Kenneth Galbraith, American economist

- I don’t believe in macro forecasts. I am not saying forecasters never right, forecasters are often right.

- Usually in economics, extrapolation works as future would look like recent past. Economy growth rate is cooked into the prices of security today. If the growth rate is as expected, security prices will not change much as its already priced in 1-2 years back.

- Money is made when forecasting growth rate is radically different than expected. Say if growth rate forecasted is 2.4% but it was -2.4% or 6%. Money will be made.

- Forecasts are very hard to make and its very hard to make them consistently.

# “The Losers Game” - Charles Ellis

The difficulty of getting it right consistently This is what makes defensive investing so important

-

Winning tennis players win by hitting winning shots. Hits shots that opponents can’t return. They’re either so well placed, or so strategic or so fast and hard that opponent can’t return them.

-

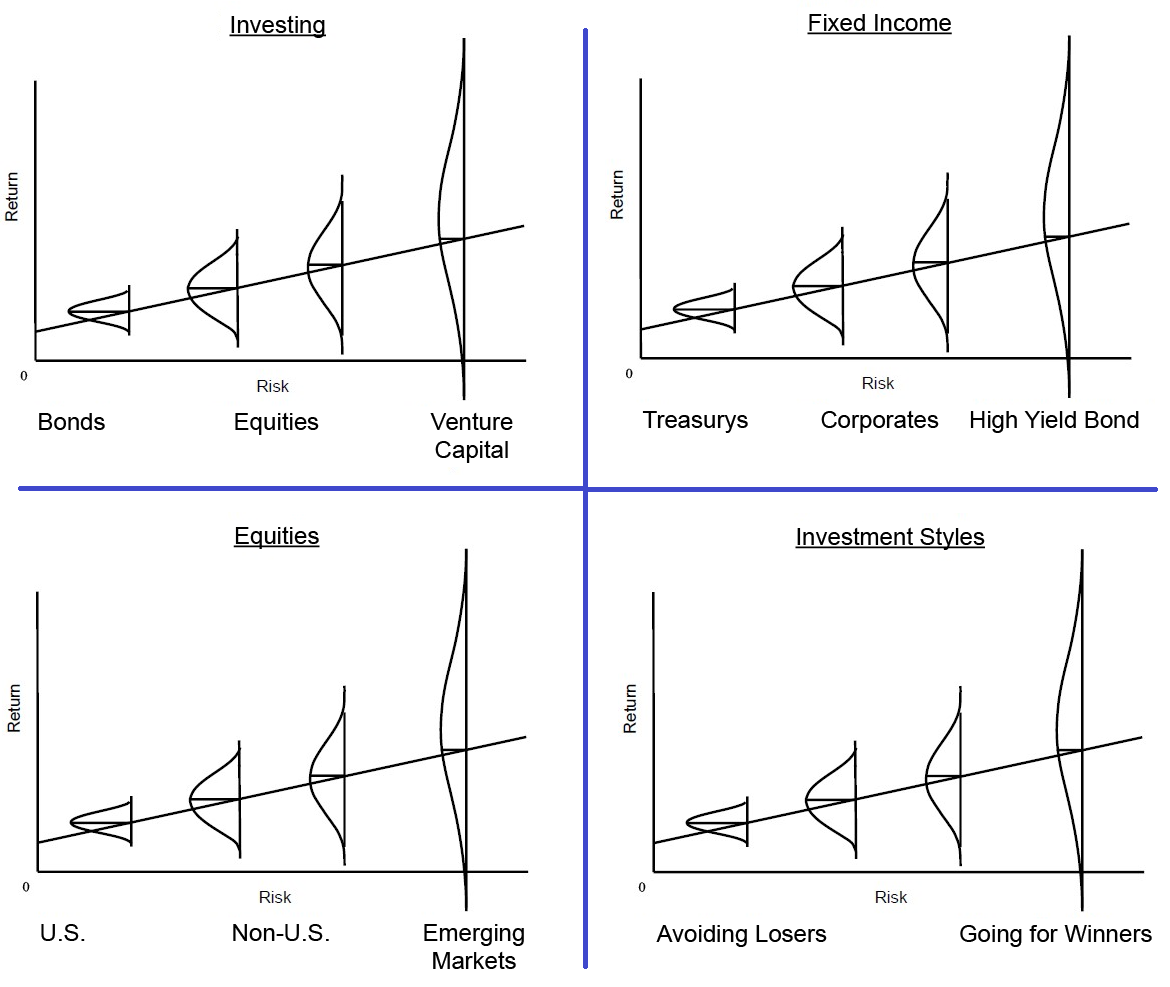

Amature tennis players win not by hitting winners but by avoiding hitting losers. We believe, if we push the ball over the net 20 times and our opponent can only do it 19. We believe we will out-steady him, outlast him and eventually he will hit it in the net or off the court. We will win the point without having hit a winner. So there are two styles of tennis and same is true for investing.

- Here, technique of hitting ball is discussed, winners are winning shots, losers are losing shots.

- If we avoid losers winners will take care of themselves.

-

Charlie believes investing in losers game, because market is efficient and securities are priced right. I also believe investing is losers game but for different reasons like there are inefficiencies, i just think its hard to consistently take advantage of them and you have to be a exceptional person to take advantage of them on a consistent basis.

-

The reasons why pro can go for winners is because he is so well schooled, practiced and steady and talented that he knows that if he does this with his foot and this with his hip and this with his elbow and this with his wrist that the ball will go where he wants. He doesn’t worry about miscues, wind, sun in his eyes or distraction. He is so well schooled. In tennis matches they keep track of something called unforced errors. They keep track of them is because there are very few. The pro doesn’t make a lot of unforced errors. Amatures make unforced errors all the time.

# Initial meeting with Michael Milken, November ‘78

If you buy triple-A bonds, there is only one way to go But if you buy single-B bonds and they survive, the surprises are like to be on the upside.

- AAA bonds are bonds that everybody think they are great. Companies are making lot of money, outlook is good, they have prudent balance sheets and everything is perfect. If everything is perfect it can’t get better, if it cant get better than it can only get worse and there is only one way to go, DOWN.

- Single B bond, I’d they survive, there is only one way to go for them, UP. On the other side, they can default and file bankruptcy.

How do you make money as a investor ?

The people who don’t know think the way you do it is by buying good assets, a good building, stock in a good company. Thats not the secret for success. The secret in success in investing buying things for less than they are worth.

Guy in the radio(NPR) in LA who i used to listen on the way to work says,

Well if you go into a store and you like the product, buy the stock.

-

Most important thing is “Figuring out what the value of an asset is” and also “relationship between price and value”.

-

In Moody’s guide to bonds in those years, “B Rated” was defined as “Fails to possess the characteristics of a desirable investment”. In other words, its a bad investment.

-

Stocks are good buy at one price and bad buy at another price. What Moody is saying is B-Rated bonds are bad buy without any reference to price. Meaning there is no price for company that has some credit risk is worth investing in.

-

So when researching B-Rated companies, we had to weed out the ones that don’t survive. Not finding the ones that will have favourable events but just excluding the ones that have unfavourable events.

-

Bond investing is negative art.

- Bond is a promise to pay. You give me $100, and I promise to give you 5% interest every year, and then give your money back in 20 years(fixed income, contract is fixed, return is fixed). So, it does not make sense to pick and choose a bond, you can blindly pick a bond that pays and that will pay. Only thing that matters is exclude the one that doesn’t pay.

-

The greatness of your performance comes not from what you buy but from what you exclude.

# Putting it together

- Taleb says the future consists of a range of possibilities with the outcome significantly influenced by randomness;

- Galbraith says forecasting is futile;

- Ellis says if the game isn’t controllable, its better to work to avoid losers than to try for winners;

- Milken says holding survivors - and avoiding defaults - is key in bond investing.

The Result - Oaktree’s Investment Philosopy

- The primacy of risk control

- For excellence in investing, the most important thing is not making lot of money, is not beating the market, its not being in top quartile, the most important thing is controling risk.

- Emphasis on consistency

- We don’t try for the moon with the danger for crashing. I want to be above the middle on a consistent basis over the long term.

- The importance of market inefficiency

- The benefits of specialization

- Macro-forecasting not critical to investing

- Its OKAY to have an opinion but you just shouldn’t act as if it’s right.

- Disavowal of market timing

- We don’t do market timing. We do long term investing on assets which are under priced.

The greatest investment adages

-

What the wise man does in the beginning, the fool does in the end

- If you find an asset which is cheap and buy it, thats great. If everybody else figures it out that its cheap, then it will go up. More people will start to jump on the bandwagon and it will go up, up and up and last person to buy it is a fool and first person to buy it is a wise man. Its the same asset, just different prices.

- People say “First the innovator, then the imitators, then the idiot”

-

Never forget the six-foot-tall man who drowned crossing the stream that was five feet deep on average.

- Portfolio has to be setup to survive on the bad days, so you wont be shaken out of your investments.

-

Being too far ahead of your time is indistinguishable from being wrong

- The things that suppose to happen, will not necessarily happen and absolutely will not happen on time.

- You will have to live until the wisdom of your decisions is proved, if at all.

All of these things, i think, say something about modesty and humility rather than cock sureness, which i think is the greatest risk.

Below were during questions section,

- Secret to happiness comes from prudence and caution. Its doesn’t come from stroke of genius on the easy streak

- People act in prudence and cautious manner during crash, thats when you turn aggressive and buy.

- You need to have economic forecast when you predict the fortunes of individual companies.

- Index fund is passive investing. It eliminates the likelihood that you fail to keep up with the index. It also eliminates the possibility of that you outperform the index. But index investor loses money every time the index goes down. Its a fine thing for Average Amature Investor.

- Now we are investing in bonds that either in default or sure to be. How will you make money in the bonds of bankrupt companies ?

- If a creditor of a company, doesn’t get paid the interest in principle as promised, they have a claim against the value of the company. And they exert that claim in a process called bankruptcy. And in bankruptcy, to oversimplify and over generalize, the old owners are wiped out and old creditors become the new owners and if bought an ownership stake through the debt for what for less that its worth, then you make money. And we have made about 23% a year for 28 years of investing in distressed debt before fees without any leverage.

# Points noted in other speeches

-

As the prices rise emotion turns more positive, until you reach the top. When price is at its maximum and emotion at its maximum, that’s where you have to be selling when price is high by definition few people do because they feel positive and ofcourse reverse is true in opposite direction at the bottom price reached its minimum in the same day investors are most depressed and most unlikely to buy. So we must do the opposite, we must stand against herd, stand against mass psychology. We must sell when fundamentals are at its peak and emotion are most positive and we must buy when fundamentals are at trough and people are depressed. Goal is to buy low sell high, more people buy high than but low.

-

Its not what you buy makes you a successful investor, it is what you pay for. What matters most is not the quality of the asset, it’s the relationship between the price and intrinsic value.

-

Experiences is what you got, when you didn’t get what you wanted.

-

History does not repeat itself, it does rhyme — Mark Twain

-

In every cycle compared to the last one, the amplitude of the fluctuations is different, the speed of the fluctuation is different, the duration of the cycle is different, the immediate causes are different and effects are different.

-

You can’t tell a quality of decision from the outcome.

-

Twin risks that investors face everyday and have to confront them.

- Risk of losing money

- Risk of losing opportunity

-

You can tell when the optimism in the market is riding high. (Company that makes no money is rising high).

-

One of the dominant characteristics of financial markets is shortness of memory. People just always forget the lessons from the past.

-

You should give up on finding a method that will always work and instead you should find a thought process that will work most of the time.

-

What is market ? It’s just a bunch of people who trade

-

You have to plan for tough times. If you don’t it means your plan is overly biased in upside and when the tough time comes you are by definition not ready.

- Risk - in general it’s the probability of bad outcomes.

-

Be aware of excesses in the environment be they extremes of economic cycle or extremes of market or investor behavior and at that time stand away from the herd. Emotional control, un-emotionality is essential, because if you are subject to the same emotions as the herd, then you’ll probably do the same things as the herd, not stand away.

-

It’s not what you buy, it’s what you pay

-

Every time something is in a bubble

-

Find something you enjoy, find something that plays to your strength and avoid your weaknesses

-

Look for something that plays to your strength, avoids your weaknesses and you enjoy it doing

# How to Think About Risk

Podcast Listened on: 2024/12/18

How to think about Risk ? Risk is counter intuitive

-

They did an experiment in Drachten, Holland. They took away all the traffic lights, signs and road markings, what do you think happened to the level of accidents and fatalities, it went down, how could it possibly have gone down, when all the road aids were gone and the answer is, people said, oh! there are no more traffic signs traffic lights or Road markings I’d better drive more carefully.

-

Jill Fredson is an expert on a avalanches and she said that better gear is created every year which makes it easier and more feasible to climb and yet the risk the number of fatalities and accidents in Climbing doesn’t go down how can that be obviously counter intuitive people see, that better gear is being invented and they say Well since we have better gear, we can do riskier things, and the level of accidents and fatalities is maintained even in in spite of the arrival of better gear

So if you think about those two examples you realize that

The risk of an activity doesn’t just lie in the activity in itself but importantly in how the participants approach it

The degree of risk present in a market or in an investment doesn’t come just from the market or the investment but how people participate in that investment and if they conclude that the market has become safer they may say that that frees them to do riskier things and that’s why I believe that risk is low when investors behave prudently and High when they don’t. Just as risk is counterintuitive I believe that risk is perverse as I said the riskiest thing in the world is the belief that there’s no risk a high level of risk Consciousness on the other hand tends to mitigate risk so when people say well that’s really risky if they take a cautious approach then it becomes safe.

As an asset declines in price, most people say oh it’s risky look, how it’s falling but with the lower price it actually becomes less risky as an asset appreciates most people say that’s a great asset look how well it’s doing but the rising price makes it riskier so again pervert and this perversity is one of the main things that render most people incapable of understanding risk.

I think it’s important to grasp a concept risk is hidden and risk is deceptive loss is what happens when risk the potential for loss collides with negative events you know.

It’s only when the tide goes out that we find out who’s been swimming naked — Warren Buffett

It’s only in times of testing that investors and their strategies are examined for the risk they really held. An example of that I wrote in my book The most important thing uh those of us who live in California as I did at the time our houses might contain a construction flaw but if all is well that flaw sits there for year after year and doesn’t produce any loss it’s only when the earthquakes occur that the house is tested and the flaws are disclosed and the risk the potential for loss turns into actual loss.

So similarly an investment can be risky but if it only exists in salutary environments it may look like a winter for a long time and it may look safe for a long time the fact that an investment is susceptible to a risk that occurs extremely rarely, what I call an improbable disaster.

The infrequency of loss can make it appear that the investment is safer than it really is — Nasim Nicholas, The Black Swan

# You Bet! - January 13, 2020

Podcast Listened on: 2025/01/03 ~ Source: The Archive: You Bet!

Lasting thing i took away from Grayson’s book was the observation that “you cant tell the quality of a decision from the outcome”.

As Grayson explained, you make the best decision you can based on what you know, but the success of your decision will be heavily influenced by (a) relevant information you may lack and (b) luck or randomness. Because of these two factors, well-thought-out decisions may fail, and poor decisions may succeed. While it might seem counterintuitive, the best decision-maker isn’t necessarily the person with the most successes, but rather the one with the best process and judgment. The two can be far from the same, and especially over a small number of trials, it can be impossible to know who’s who.

— In 1978, I switched to Citi’s bond department, and I was asked to start a high yield bond fund. Now I was investing in the bonds of the worst public companies in America – all rated speculative grade, or “junk.” And I was making good money safely and steadily. Not because the companies were flawless – in fact, about 4% by dollar amount would go on to default each year on average – but because “the price” was too favorable to those who bet on them.

This experience produced two of my most important observations:

- Success in investing doesn’t come from buying good things, but from buying things well, and it’s essential to know the difference.

- It’s not a matter of what you buy, but what you pay for it. Nifty Fifty investors spent all of their time picking favorites and failed to notice that the prices they paid were too high. Mostly winning companies, but poor investments

— Some points from book “Thinking in Bets - Annie Duke”

- When we think probabilistically, we are less likely to use adverse results alone as proof that we made a decision error, because we recognize the possibility that the decision might have been good but luck and/or incomplete information (and a sample size of one) intervened.

- Maybe we made the best decisions from a set of unappealing choices, none of which were likely to turn out well.

- Maybe we committed our resources on a long shot because the payout more than compensated for the risk, but the long shot didn’t come in this time.

- Maybe we made the best choice based on the available information, but decisive information was hidden and we could not have known about it.

- Maybe we chose a path with very high likelihood of success and got unlucky… .

How can we be sure that we are choosing the alternative that is best for us? What if another alternative would bring us more happiness, satisfaction, or money? The answer, of course, is we can’t be sure. Things outside our control (luck) can influence the result. The futures we imagine are merely possible. They haven’t happened yet. We can only make our best guess, given what we know and don’t know, at what the future will look like… . When we decide, we are betting whatever we value … on one of a set of possible and uncertain futures. That is where the risk is

# Fewer Losers, or More Winners? - September 12, 2023

Podcast Listened on: 2025/01/03 ~ Source: Fewer Losers, or More Winners?

From Graham and Dodd’s Security Analysis description of “fixed-value” (or fixed-income) investing as “a negative art.” What did they mean?

At first, I found their observation cynical, but then I realized what they were saying. Let’s assume there are one hundred 8% bonds outstanding. Let’s further assume that ninety will pay interest and principal as promised and ten will default. Since they’re all 8% bonds, all the ones that pay will deliver the same 8% return – it doesn’t matter which ones you bought. The only thing that matters is whether you bought any of the ten that defaulted. In other words, bond investors improve their performance not through what they buy, but through what they exclude – not by finding winners, but by avoiding losers. There it is: a negative art.

— Risk control isn’t everything; it is the only thing

Understanding the distinction between risk control and risk avoidance is truly essential for investors. Risk avoidance basically consists of not doing anything where the outcome is uncertain and could be negative. And yet, at its heart, investing consists of bearing uncertainty in the pursuit of attractive returns. For this reason, risk avoidance usually equates to return avoidance. You can avoid risk by buying Treasury bills or putting your money into government-insured deposits, but there’s a reason why the returns on these are generally the lowest available in the investment world. Why should you be well paid for parting with your money for a while if you’re sure to get it back?

Risk control, on the other hand, consists of declining to take risks that (a) exceed the quantum of risk you want to live with and/or (b) you wouldn’t be well rewarded for bearing.

— There are two kinds of tennis players … actually, two different types of tennis games.

Professionals play a winner’s game: They win by hitting winners (in tennis, that means shots the opponent can’t return). Since their game is so much within their control, they can usually produce the shots they want, the best of which win points. But amateur tennis is a loser’s game: The winner is usually the person who hits the fewest losers. If you can just keep the ball in play long enough, eventually your opponent will hit it off the court or into the net. The amateur doesn’t have to hit winners to win, and that’s a good thing

# What Really Matters - November 22, 2022

Podcast Listened on: 2025/01/03 ~ Source: What Really Matters?

What Doesn’t Matter: Hyper-Activity Most investors trade too much. Since it’s hard to make multiple consecutive decisions correctly, and trading costs money and is often likely to result from an investor’s emotional swings, it’s better to do less of it.

When I was a boy, there was a popular saying: Don’t just sit there; do something. But for investing, I’d invert it: Don’t just do something; sit there. Develop the mindset that you don’t make money on what you buy and sell; you make money (hopefully) on what you hold. Think more. Trade less. Make fewer, but more consequential, trades. Over-diversification reduces the importance of each trade; thus it can allow investors to take actions without adequate investigation or great conviction. I think most portfolios are overdiversified and over-traded.

A news item that has gotten a lot of attention recently concerned an internal performance review of Fidelity accounts to determine which type of investors received the best returns between 2003 and 2013. The customer account audit revealed that the best investors were either dead or inactive – the people who switched jobs and “forgot” about an old 401(k) leaving the current options in place, or the people who died and the assets were frozen while the estate handled the assets. (“Fidelity’s Best Investors Are Dead,” The Conservative Income Investor, April 8, 2020)

A Special Word in Closing: Asymmetry “Asymmetry” is a concept I’ve been conscious of for decades and consider more important with every passing year. It’s my word for the essence of investment excellence and a standard against which investors should be measured.

First, some definitions:

- I’m going to talk below about whether an investor has “alpha.” Alpha is technically defined as return in excess of the benchmark return, but I prefer to think of it as superior investing skill. It’s the ability to find and exploit inefficiencies when they’re present.

- Inefficiencies – mispricings or mistakes – represent instances when an asset’s price diverges from its fair value. These divergences can show up as bargains or the opposite, over-pricings.

- Bargains will dependably perform better than other investments over time after adjustment for their riskiness. Over-pricings will do the opposite.

- “Beta” is an investor’s or a portfolio’s relative volatility, also described as relative sensitivity or systematic risk.

In my view, asymmetry is present when an investor can repeatedly do some or all of the following:

- make more money in good markets than he gives back in bad markets,

- have more winners than losers,

- make more money on his winners than he loses on his losers,

- do well when his aggressive or defensive bias proves timely but not badly when it doesn’t,

- do well when his sector or strategy is in favor but not badly when it isn’t, and

- construct portfolios so that most of the surprises are on the upside.