The Value of Stories in Business, Talks at Google, Aswath Damodaran

— nfwyt, quest-for-wealth — 3 min read

If I ask you to classify you as a person, would you naturally think of yourself as a number cruncher or story teller.

Story is what gives soul to your valuation.

You valuate companies because you want to act on those valuations. If i find something undervalued, i need to be able to buy that stock. But its all numbers, whats missing is capacity to tell a story.

Delusions of Number Crunchers

- Precision : When in doubt add more decimals

- Objectivity : Numbers has no bias

- Control : Data can control reality

Delusions of Story tellers

- Creativity cannot be quantified

- If the story is good, investment will be

- Experience is the best teacher.

Learn enough number crunching skills to develop into a disciplined story tellers.

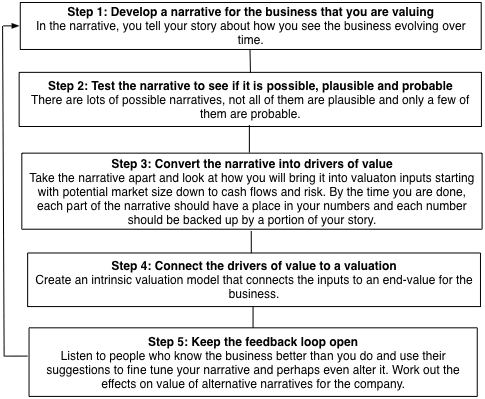

From story to number : The steps

Step 1 : Develop a narrative for the business that you are valuing.

- In the narrative, you tell your story about how you see the business evolving over time.

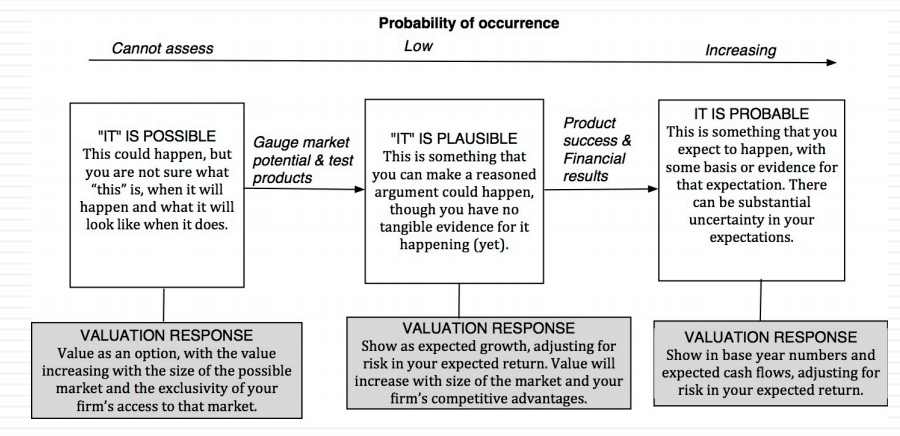

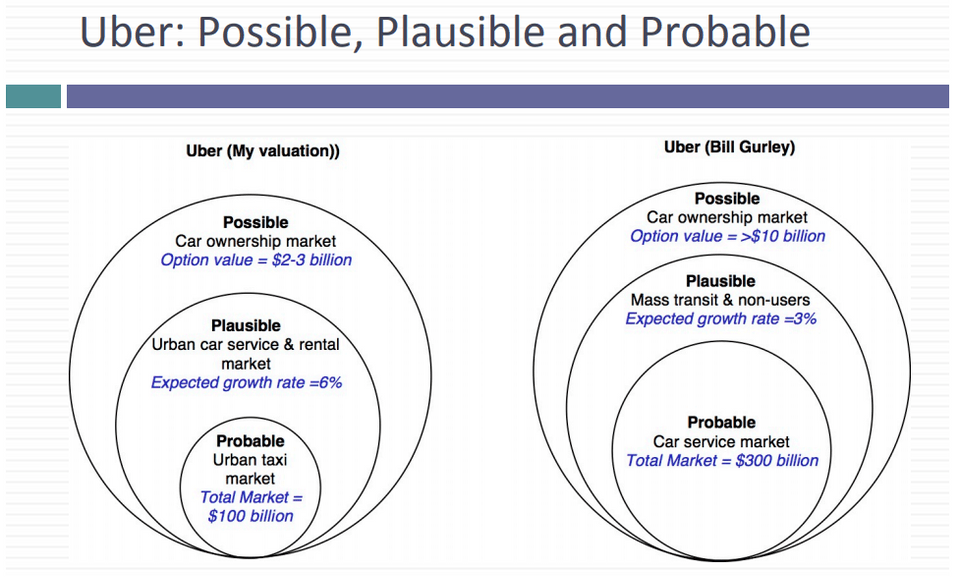

Step 2 : Test the narrative to see its not a fairy tale. So, got ask three questions,

- Is it possible ?

- Is it plausible ?

- Is it probable ?

- There are lots of possible narratives, not all of them are plausible and only a few of them are probable.

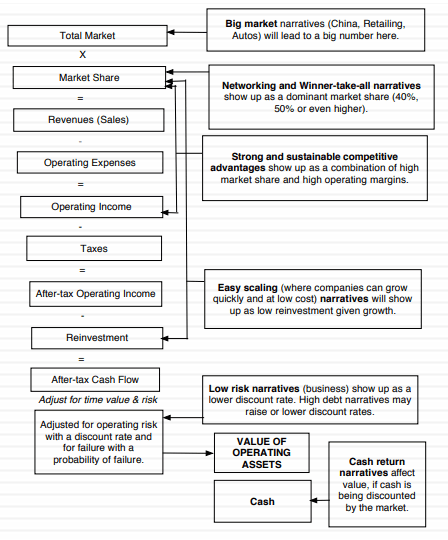

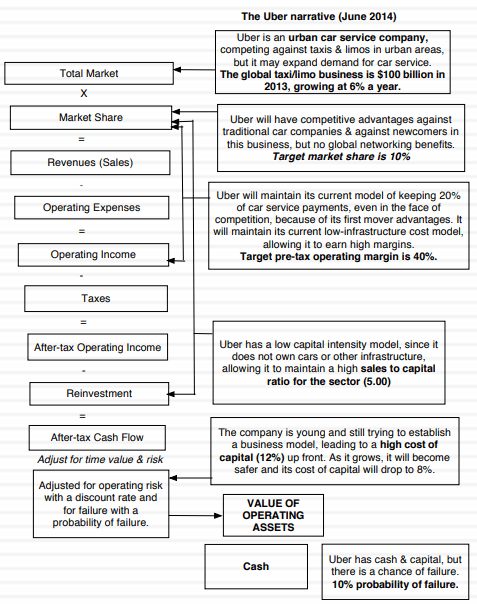

Step 3 : Convert the narrative into drivers of value

- Take the narrative apart and look at how you will bring it into valuation inputs starting with potential market size down to cash flows and risk. By the time you are done, each part of the narrative should have a place in your numbers and each number should be backed up a portion of your story.

Step 4 : Connect the drivers of value to a valuation

- Create an intrinsic valuation model that connects the inputs to an end-value the business.

Step 5 : Keep the feedback loop open

- Listen to people who know the business better than you do and use their suggestions to fine tune your narrative and perhaps even alter it. Work out the effects on value of alernative narratives for the company.

Seek out people who think least like you. Like people who say "this is horrible", listen to them, they can give a new way to think.

# Step 1: Survey the landscape

Understand the company its business model financials, business mix and the story.

Look through its financial statements.

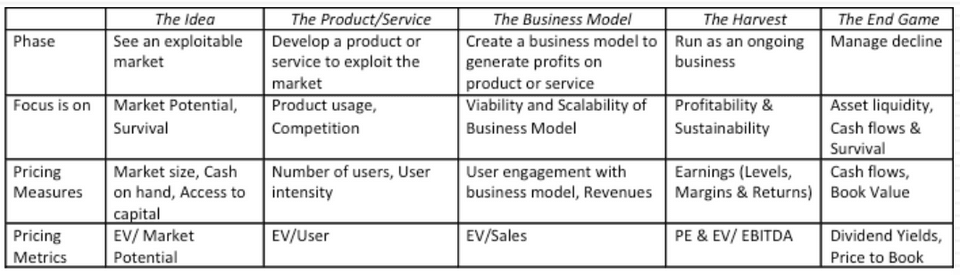

VC don't value companies they price it. Buy it at low sell it in high

Talk to people to learn more about the company

- Why people like its products

- Why do they work for it

- Get to know the business model

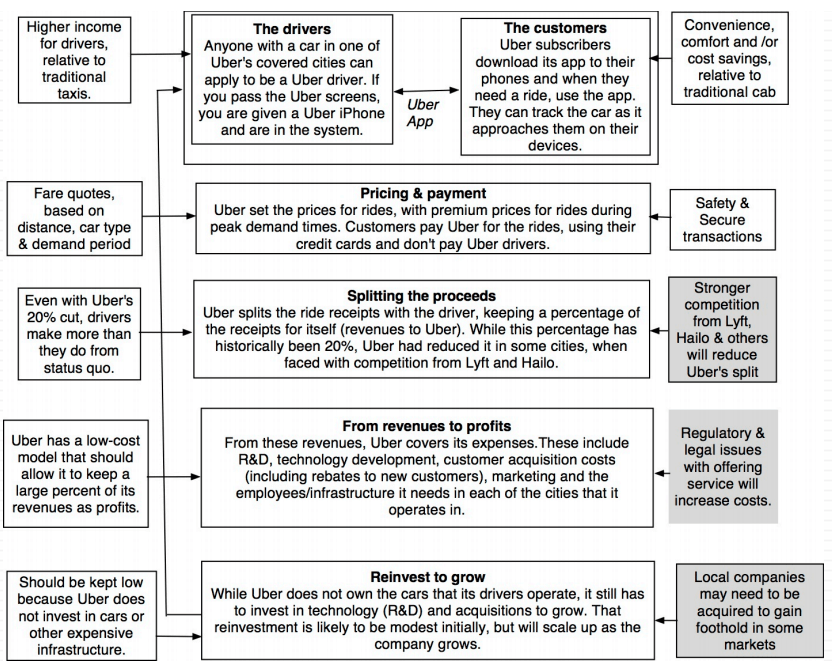

Uber : Can scale up very fast and less capital business. They just have to sign up cab drivers.

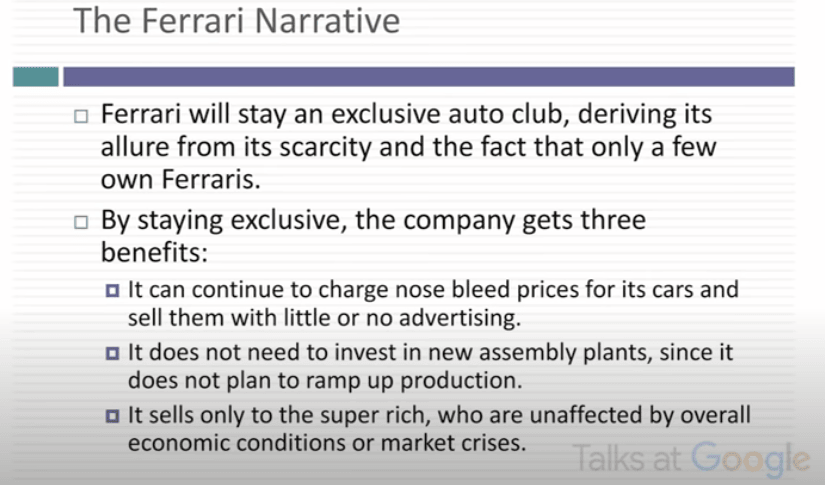

In general, Automobile is one of bad businesses

Car business model : Low revenue growth, less margin and lots of reinvestment.

Growth of any companies would be need new plants

Goodwill is a nonasset

Uber business model

# Step 2: Create a narrative for the future

- Every valuation starts with a narrative, a story that you see unfolding for your company in the future.

- In developing this narrative, you will be making assessments of

- Your company (its products, its management and its history)

- The market or markets that you see it growing in.

- The competition it faces and will face.

- The macro environment in which it operates.

- Rule 1: Keep it simple.

- Rule 2: Keep it focused.

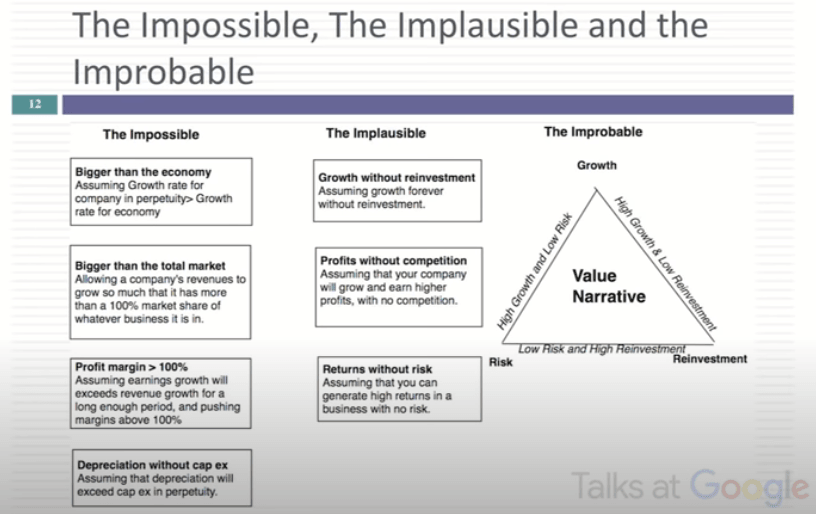

# Step 3 : Check the narrative against history, economic first principles & common sense

Example of impossible : Netflix in 10yrs 600 billion and one subscriber pays around $100/year. Total subscribers required to reach $600 billion : $600 billion / 100 per year per subscriber = 6 billion subscribers required If they get entire population of the world subscribe they can reach $600 billion revenue.

1 in 3 valuations are impossible even the big names.

Example of implausible : Sport Event threatening the city to refurbish stadium. Works all the time. Keyword is "we are moving game to las vegas"

- Measure the company against successful companies in the same business.( In Ads, Google Vs. Facebook )

If someone says there is growth and there is nothing set aside to create the growth. Its not going to happen.

# Step 4 : Connect your narrative to key drivers of value

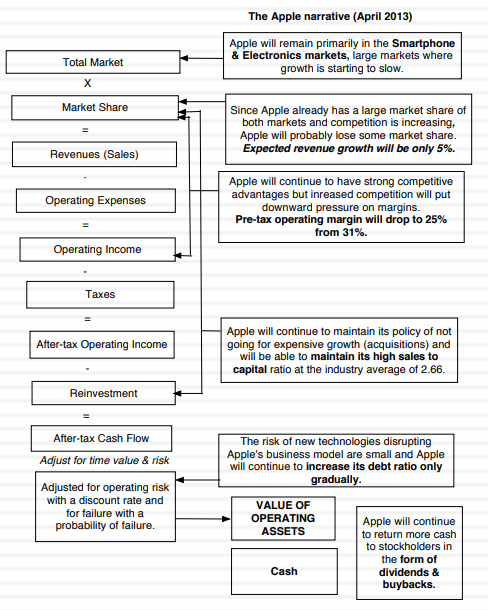

Apple narrative(April 2013)

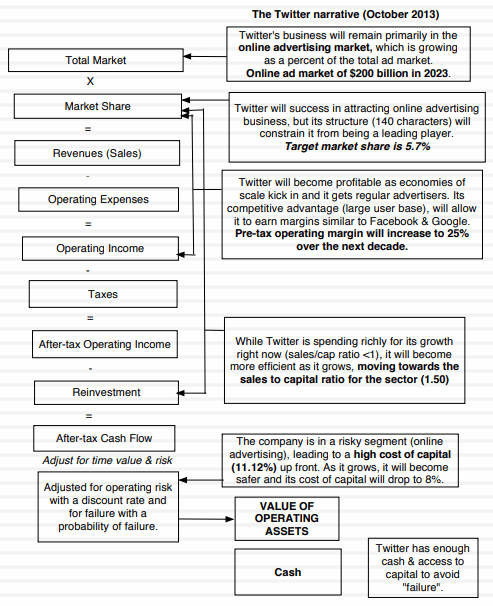

Twitter narrative(October 2013)

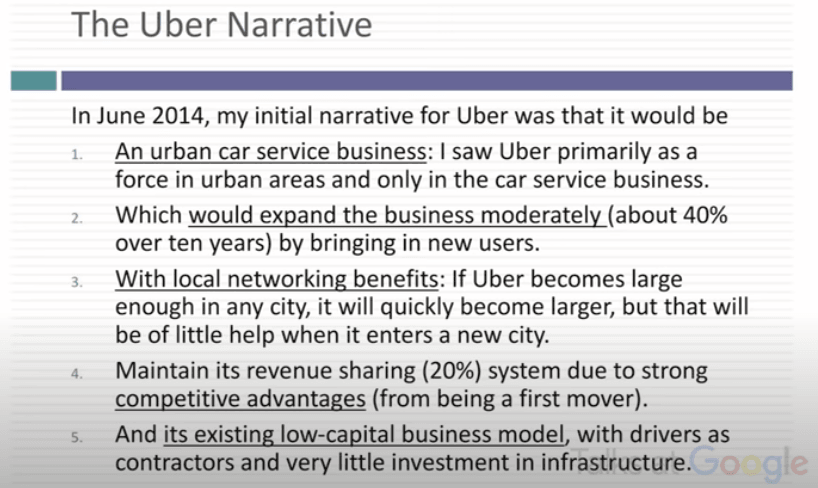

Uber narrative(June 2014)

# Step 5: Keep the feedback loop open

- When you tell a story about a company (either explicitly or implicitly), it is natural to feel attached to that story and to defend it against all attacks. Nothing can destroy an investor more than hubris.

- Being open to other views about a company is not easy, but here are some suggestions that may help:

- Face up to the uncertainty in your own estimates of value.

- Present the valuation to people who don't think like you do.

- Create a process where people who disagree with you the most have a say.

- Provide a structure where the criticisms can be specific and pointed, rather than general.

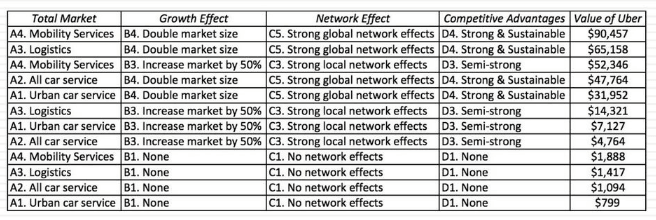

Uber example ( Different Narrative, Different Numbers )

A Company can convince that can do stuff, you never thought they could do

Focus changes