Skip to content

Class of Aswath Damodaran

— nfwyt, quest-for-wealth — 3 min read

Valuation Tools - Reading a 10K,Annual Reports

- Financial Disclosures have become data dumps

- In todays world, its not that you don't have information but you have to separate out information that matters from that don't.

- By reading 10K or Annual reports, when you read a information. You have to think, what valuation is going to be changed by this particular information

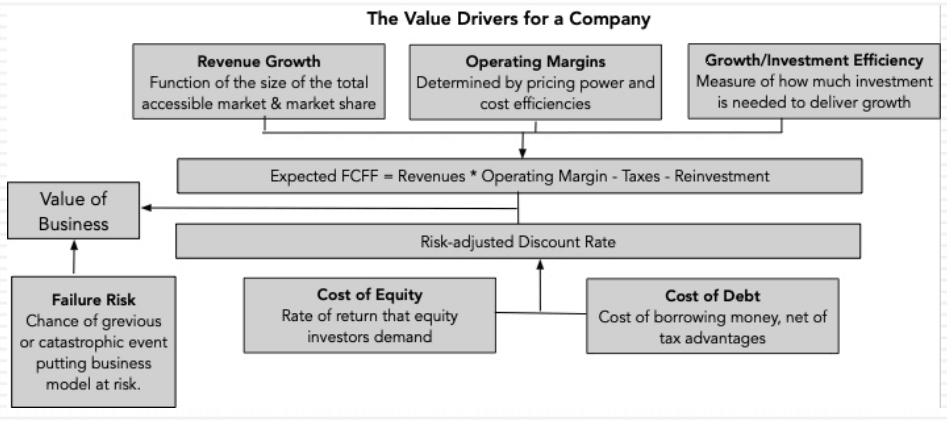

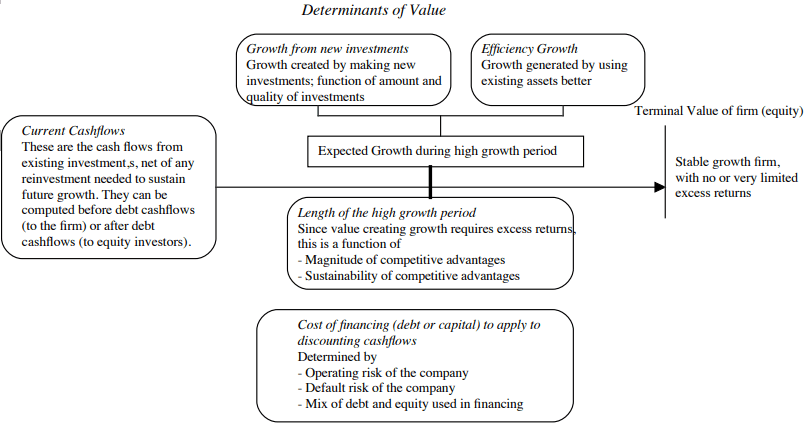

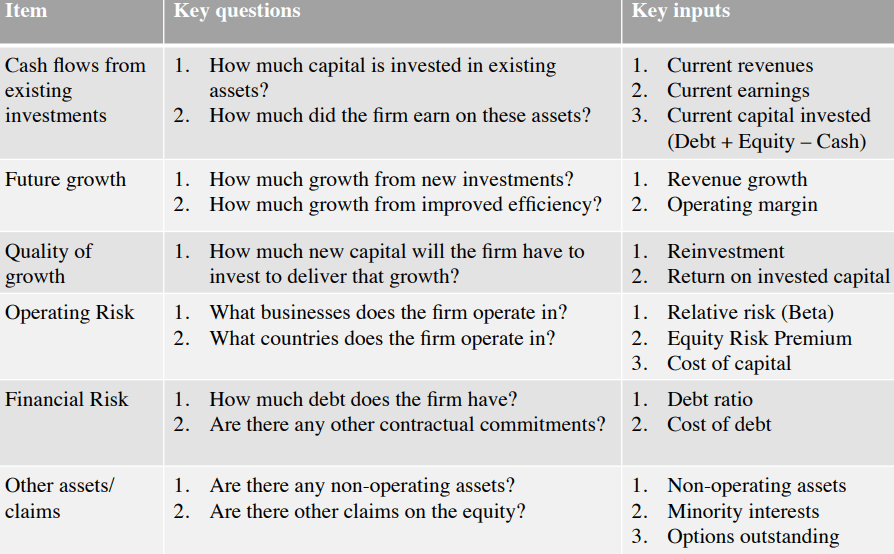

- Value of a company rests on 4 Pillars(Cashflow, Growth, Length of the high growth period, Risk comes from operations/Financial Risk, when will the company become matured)

What are the cashflows from existing assets ?

- Equity: Cashflows after debt payments

- Firm: Cashflows before debt paymetns

What is the value added by growth assets ?

- Equity: Growth in equity earnings/cashflows

- Firm: Growth in operating earnings/cashflows

How risky are the cash flows from both existing assets and growth assets ?

- Equity: Risk in equity in the company

- Firm: Risk in the firms operations

When will that firm become a mature firm, and what are the potential roadblocks?

Key Valuation Questions

Template for reading financial disclosures

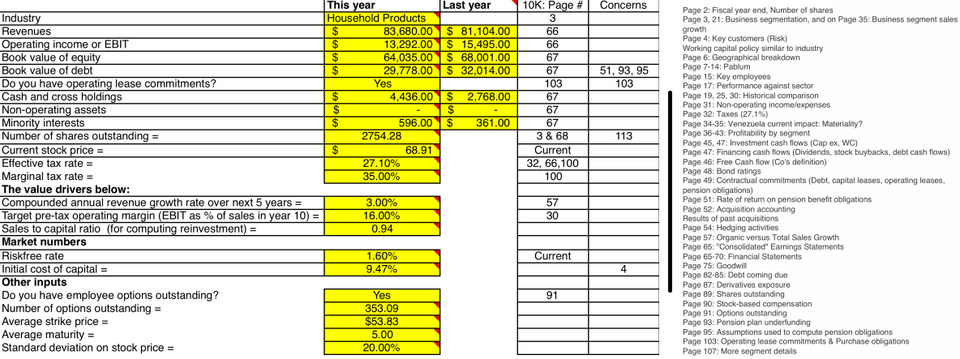

Timing & Currency

- Calender year or April-March

- Its easy to make assumption, if its a US company it will be dollars. Check anyway as most commodity companies report in $'s even if they are in russia.

Business mix

- Look for breakdown by segment and look at geographic if any.

- Read out risk section that company will list out. There might be some generic risks but look specifics.

Base year inputs for valuation

- Income Statement: Revenues, Earnings, Interest Expenses, Tax rate

- Balance sheet: Book equity, debt outstanding, Cash & Working Capital(WC), Cross holdings(minority & majority)

- Cross holdings - If it wons 10%-15% check asset side holding in another company. If it holds >50% thats a majority holdings, most countries, companies are required to consolidate. Part they don't hold come up in the Liability side as minority interest.

- Cashflows : Change in WC, Capital Expenditures, Depreciation, Debt issued(repaid).

Follow through

- Look for leases or rental or other commitments

- Employee compensation, they have to tell how many granted options outstanding, when they come due and whats the average exercise price is.

- Some companies tell how much debt is coming to you in one year, two year...

Units

- How many shares are outstanding

- Look if they have restricted stock units(RSU: stocks which cannot be traded for certain period of time)

- Acquistions paid for with stock

Corporate Governance

- Differences in voting rights across share classes, special rights or privileges given to insiders etc.

Parting Advice

Read the 10K or Annual Reports and make note of pages like below

- Skip the pablum - legal boilerplate

- Dont sweat the small stuff - Like in P&G annual report, they spoke about 3 pages about Venezuela, if 30% of the companies revenue comes from Venezuela you need to care about that but if its very very less. Don't worry about it.

- Cross check - When you look at 'Statement of Cashflow', you get a number for Capital Expenditure which is you are investing in long term assets. But remember what you invest in long term assets should also increase the number on the balance sheet, fixed assets in the BS should increase in that amount. You don't get same numbers, but it wont vary largely.

Session 5A: Accounting Inconsistencies

- Tax Rates

- As companies age, the Effective Tax Rate will move towards marginal tax rates.

- Negative tax rates - If a company gets a tax credit from the government previous year. So, current year it can get negative tax rate. This could be a one time thing.

- Deferred Tax Liabilities - Expected to pay more tax in future because you saved on taxes in the past.

- Defereed Tax Assets - Expected to pay lower taxes in the future

- Non-debt Commitments

- Interest-bearing debt will show up on balance sheets.

- There are contractual commitments that should show up as debt like operating leases

- Due to this Debt increases and in the balance sheet to balance counter asset is created equivalent to lease debt.

- Operating income changes, since you add back the current years lease expense and reduce it by depreciation. Net income does not or should not change.

- Interest expenses go up by the interest portion of the current years lease payment.

- Depreciation is increased by the depreciation on the lease asset(using the prior years value)

- Taxes and net income do not change, since you replace one tax deductible expense(operating lease) with two(interest and depreciation) of equivalent value.

- Non-Physical Capital Expenses

- Accountants almost always treat investments in physical assets as capital expenses(CapEx) and show them on the balance sheet, they are inconsistent and unpredictable when it comes to investments in non-physical assets.

- A pharma company that buys a patent from another one is allowed to treat that expenditure as a capital expenditure, but one that does R&D to arrive at the same result is not.

- A company reliant on human capital(consulting) for its value is almost never required to treat what it invests in human capital for the long term(recruiting and training) as capital expenditures.

- A subscriber/user based company that spends money acquiring users or subscribers generally is not allowed to treat the money spent acquiring customers as capital expenditures.

- Stock Based Compensation

- Granted options are treated as expenses. Options will be converted to shares and that will increase the outstanding shares.