The Little Book that Builds Wealth, Pat Dorsey

— nfwyt, quest-for-wealth — 3 min read

Capitalism Works

- Capital seeks the highest returns possible: High profits attract competition.

- So....most businesses with high returns on capital will see returns decrease over time.

Moat Basics

Economic moats are structural & sustainable qualities that are inherent to the business.

- Not hot products. (Heelys? Krispy Kreme?Sugar is a moat)

- Not just a cool piece of tech (lomega?In tech there will be a newer with more advanced product)

- Not the biggest market share (GM? Compaq?)

Moats generally manifest themselves in pricing power: A company that can't raise prices is unlikely to have a strong moat.

INFO: We looked at companies that maintained Return on Capital above Cost of Capital for 15+ years.

- What are the common characteristics of these business

- Whats the similarities in these business

Intangible Assets

Brands

- Increase willingness to pay / lower search costs

- Sony(Tech product:who buys VCD Players) vs. Tiffany(Diamonds, its worth it)

- Amazon, Groupe Richemont, Coca Cola İçecek

- Increase willingness to pay / lower search costs

Patents

Legal monopoly vs. expiry/challenge/piracy

- If one drug is driving all the economic value, if that patent is getting challenged, you are dead. So, you have to be very careful.

- Novo Nordisk, Qualcomm, Chr. Hansen

Licenses/ Approvals

- Legal oligopoly vs. regulatory fiat

- Casinos(limited licenses), landfills(nobody likes to live there, less number licenses), aircraft parts(Most of the parts are made by one company, good business)

Widening the Moat: Brands

Brands are valuable if they deliver a consistent or aspirational experience.

- Consistency lowers search costs & drives loyalty. Don't change & give people a reason to switch!

- Mistake: New Coke, The Schlitz

- Consistency lowers search costs & drives loyalty. Don't change & give people a reason to switch!

Aspiration increases willingness to pay. So, create scarcity & exclusivity. +Tiffany's store layout(40% revenue comes from stuff that costs less than $200 and shop layout is like costly items in front and cheap at last) +"You don't own a Patek Philippe, you merely take care of it for the next generation."

Confidence is how other people see you.

Switching Costs

Does the cost of switching to a competing product or service outweigh the benefits?

Integrate with customer's business: Upfront costs of implementation payback from renewals

- Silverlake Axis, Oracle, SimCorp

- Migrating to Oracle to another database is a expensive thing for a multi-national company, they will not go for it. So, lock-in is a good thing.

Sell ongoing service relationships

- Rolls Royce, Otis, Kone, Schindler

- Kone is a elevator company, once a elevator is setup, its not coming out. Rolls Royce, sells JetEngine they change you by the hour. You pay is related to how much you use it.

Provide a product with a high benefit/cost ratio

- Fastenal(Makes bolts, product doesn't cost much, but brings huge economic cost to the company), Ecolab, Novozymes, Fuchs Petrolub

- Lubricant which improves performance of a mining machine, that lubricant costs less when compared to the actual machine or production, so even if they increase 20%, they will pay for it.

The Network Effect

Provide a service that increases in value as the number of users expands.

Aggregate demand b/t fragmented parties.

- Edenred, Henry Schein(used by dentists), XPO Logistics

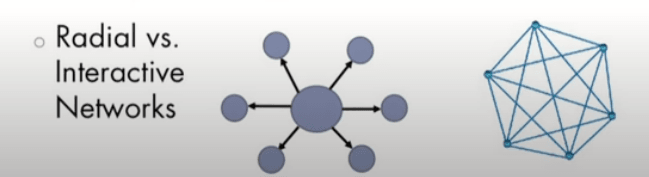

Non-linearity of nodes vs. connections.

- Visa, Mastercard, Facebook

Western Union is Radial, they have lots of branches but nobody is sending money from Bangladesh to Chicago or Mexico

Cost Advantages

Process: Invent a cheaper way to deliver a product that can't be replicated quickly.

- Inditex, RyanAir, GEICO, Dell

Scale: Spread fixed costs over a large base. Relative size matters more than absolute size.

- UPS, Aggreko, Stericycle

Niche: Establish minimum efficient scale

What About Management?

- "Good jockeys will do well on good horses, but not on broken-down nags." (Buffett)

Moats, Management & Mistakes

- Moats can buffer management mistakes

- Microsoft minted money despite Steve Ballmer

- New Coke didn't kill Coca-Cola

- Moodys put profits before integrity, and still cranked out a 40% operating margin

- But even a genius like David Neeleman couldn't change that fact that JetBlue is an airline - the worst industry known to mankind.

The Good & the Bad

Good managers are constantly looking for ways to widen a company's moat

- Amazon's focus on the customer experience(There is a lots of trust involved)

- Costco's focus on using scale to lower costs

Bad managers invest capital outside a company's moat, lowering overall ROIC

- This process is called "deworsification," or "setting fire to large piles of cash."

- Example Cisco -- Starting a consumer business, Garmin -- Starting a GPS Handset business(Every phone has GPS)

An Exception to Every Rule

A tiny minority of managers can create enormous value via astute capital allocation - even if they don't start with great horses.

- Warren Buffett (Berkshire), Brian Joffe (Bidvest), Dick Kovacevich (Wells Fargo), Steve & Mitch Rales (Danaher)

They are hard to find, and false positives abound...but they can create enormous wealth over time. Keep an eye out!

Valuing Moats

The value of an economic moat is largely dependent on reinvestment opportunities

The ability to reinveset tons of cash at a high incremenetal ROIC = a very valuable moat.

- Fastenal, XPO, Curro

If a firm has limited ability to reinvest, the moat adds little to intrinsic value. +McCormick, Microsoft, Oracle

Isn't Moat Already Priced In ?

- Moats usually matter in the long run than in short

- Most investors assume the current state of the world persists longer than it usually does.

Finding Moats = Finding Inefficiency

- Quantitative data is efficiently priced in

- Qualitative insight is less efficiently priced

Moats in a Global Context

Local differences create moats

- Canadian banks, Edenred, German car washes

Minimum efficient scale is more common South African retailers, Globo, BEC World

Cultural preferences create barriers to entry Beer travels. Candy & snacks generally don't.