Peter Thiel's thoughts and views

— nfwyt — 27 min read

Table of contents

- You Are Not a Lottery Ticket - 2013

- Zero to One - 2013

- Competition is for Losers 2014

- Peter Thiels view on Christianity and approach towards future

Peter Thiel, You Are Not a Lottery Ticket - 2013

Below notes from below class and youtube videos,

Globalization is basically about copying things that already work. China story. Copy ideas that work from developed nations. avoid copying bad ideas.

When you go from 0 to 1, if you look at every event in the history of progress in the history of technology and science has something singular and non-repeatable about it. And if we ask is the given invention, is the given startup, is the given artistic achievement was this something happened anyway or was this something total fluke. Its is a really hard question to answer as this has sample size of 1.

Question of Luck

A. Nature of the Problem

The biggest philosophical question underlying startups is how much luck is involved when they succeed. As important as the luck vs. skill question is, however, it’s very hard to get a good handle on. Statistical tools are meaningless if you have a sample size of one. It would be great if you could run experiments. Start Facebook 1,000 times under identical conditions. If it works 1,000 out of 1,000 times, you’d conclude it was skill. If it worked just 1 time, you’d conclude it was just luck. But obviously these experiments are impossible.

Some people gravitate toward explaining things as lucky. Others are inclined to find a greater degree of skill. It depends on which narrative you buy. The internal narrative is that talented people got together, worked hard, and made things work. The external narrative chalks things up to right place, right time. You can change your mind about all this, but it’s tough to have a really principled, well-reasoned view on way or the other.

But people do tend to be extremely biased towards the luck side of things. Skill probably plays a much greater role than people typically think.

B. Anti-Luck

The weak argument against the luck hypothesis involves presenting scattered data points as evidence of repeatability. Several people have successfully started multiple companies that became worth more than a billion dollars.

People have repeated successes and some people say they have just Big breakthrough and everything else was leveraged off that.

- Steve Jobs - Apple 🡪 Pixar

- Jack Dorsey - Square 🡪 Twitter

- Elon Musk - Paypal 🡪 Tesla 🡪 Solar City 🡪 Space X

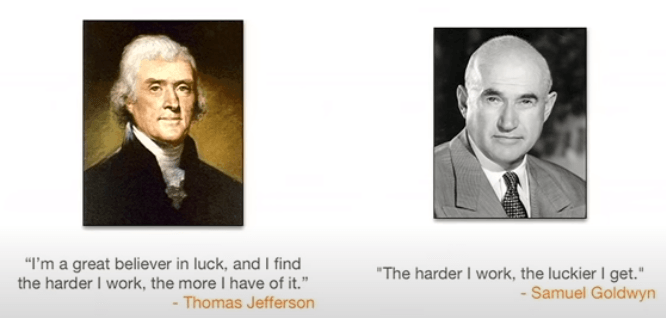

C. Sign of The Times

It’s worth noting how much perspectives on this have changed over time.

Luck is something overcome or mastered

From the 18th century all the way through the 1950s or ‘60s, luck was perceived as something to be mastered, dominated, and controlled. It was not this weird external force that couldn’t be understood.

Today’s default view is more Malcolm Gladwell than Thomas Jefferson; success, we are told, “seems to stem as much from context as from personal attributes." You can’t control your destiny. Things have to combine just right. It’s all kind of an accident.

D. Applied to Startups

The theme that luck plays a big role is also dominant in the startup community. Paul Graham has attributed a great deal of startups’ success to luck. Robert Cringely wrote a book called Accidental Empires. The point is not to pick on these people—they’re obviously very competent and quite successful.

This is further illustrated by considering what would happen if a successful entrepreneur publicly stated that his success was fully attributable to skill. That entrepreneur would be perceived as ridiculous, arrogant, and wrong. The level of proof that he offered or the soundness of his arguments wouldn’t matter. When we know that someone successful is skilled, we tend to discount that or not to talk about it. There’s always a large role for luck. No one is allowed to show how he actually controlled everything.

It’s worth noting that the existence of this class—being willing to teach this class—is a structural reason in support of the anti-luck bias. A class on startups would be worthless if it simply relayed a bunch of stories about people who won lotteries. To the extent it’s all a matter of luck, there is no point in learning very much. But it’s not all a matter of luck. And the part of it that is can be channeled and mastered.

When you drill down and ask a question like so was luck or not luck, its really hard to say.

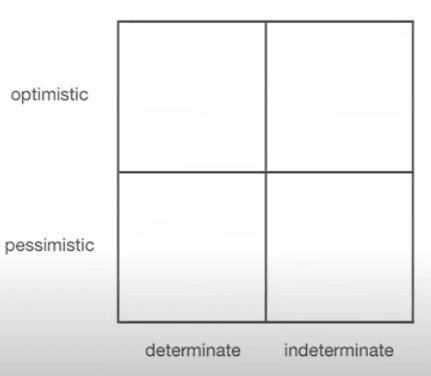

Determinate Vs. Indeterminate futures

As a society, we now gravitate towards explaining things by chance and luck rather than skill and calculation. All we can do here is point out that we seem to have shifted to the extreme luck side of the spectrum and suggest that it might make sense to dial back the pendulum the other way.

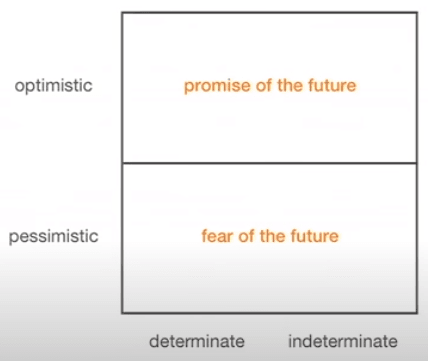

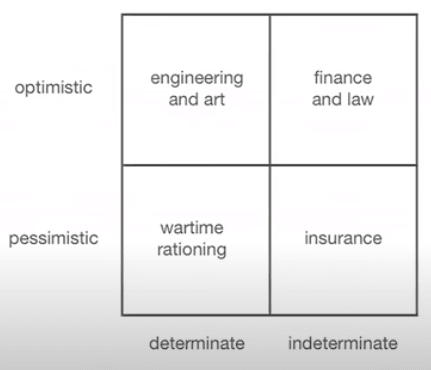

Naturally, we can use a 2 x 2 matrix to help us think about the future. On the vertical axis you have optimism and pessimism. On the horizontal axis you have determinate and indeterminate. The determinate perspective is that things are knowable and you can control them. The indeterminate perspective is that things are unknowable and uncontrollable. There are just too many chance events.

Future Framework

You can simplistically say from this 2x2 matrix, that future is either optimistic or pessimistic and either determinate or indeterminate

- Optimistic future were generally everything will better

- Pessimistic future is were generally everything will be worse

- Determinate future is sort of map out reasonable amounts of it and plan against it.

- Indeterminate future is something you have no clue and you have random walk all way.

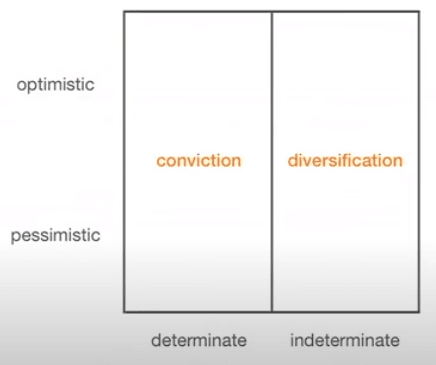

Certainly depending on which of these quadrants you believe is basically correct about the future it tells you very different approach you pursue in terms of your life and how things you are doing.

- If you believe future is determinate, you will act with some degree of conviction and specific ideas and have some confidence to work towards those ideas

- If its indeterminate, number one rule is to diversify because you have no idea whats gonna work and try lots of different things approach to the future.

If you believe that the future is fundamentally indeterminate, you would stress diversification. This is true whether you’re optimistic or pessimistic. And indeed, chasing optionality seems to be what most everybody does. People go to junior high and then high school. They do all sorts of activities and join lots of clubs along the way. They basically spend 10 years building a diverse resume. They are preparing for a completely unknowable future. Whatever winds up happening, the diversely prepared can find something in their resume to build on.

If the future is determinate, it makes much more sense to have firm convictions. There is just one thing—the best thing—that you should do. This is decidedly not how people build up their resumes these days.

Overlay this diversification/conviction dynamic over the optimism/pessimism question and you get further refinement. Whether you look forward to the future or are afraid of it ends up making a big difference.

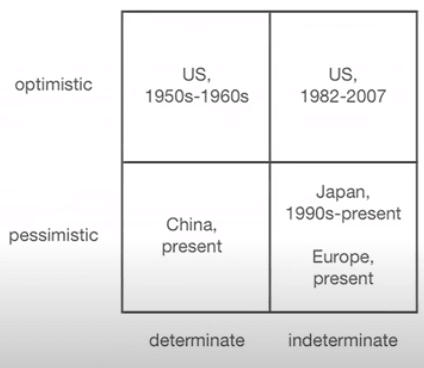

From historical perspective

- Determinate Optimism : US in 50s and 60s and even before that, the future is clearly going to be better. People thought next generation is going to be better than their generation. Cars are getting faster, planes are getting faster and rockets are getting faster.

- Indeterminate Optimism : US in 80s to 2007 - People still had the idea that future is going to be better, but if you ask How or Why, people had really no good answer. They were in indeterminate optimism.

- Indeterminate Pessimism : Japan have been in the indeterminate pessimism from 90s to Present. People have idea that future is going to be not that great could be worse and nobody had idea what to do and Europe also going into this quadrant, people thing Future is worse and nobody has any idea what to do.

- Determinate Pessimism : People in China know how its gonna look in 20 years, they know there will highways and cities. For the most part, I think its gonna be poor version of developed world, people will get old before they get rich.

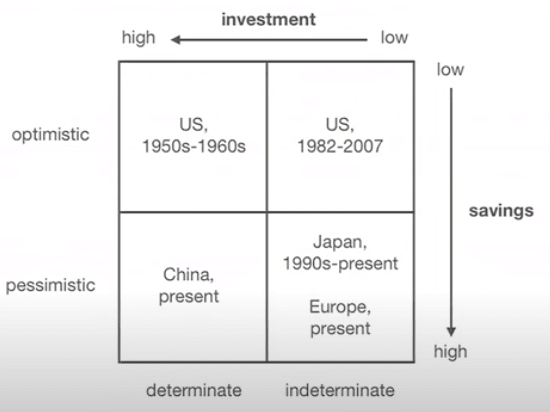

If you look at these quadrants at financial way

- If you are optimistic you don't need to save lot of money; If you are pessimistic you save a lot of money

- So if you are very optimistic, you will end up with saving rate which is very low. US savings rate stands at -6%.

- China is very pessimistic, their savings rate is at 30% of GDP. They are getting better and better each year but they think they will get old before they get rich so they are saving money. People like to criticize this because it seems odd to them that poor people are saving money while rich people in the U.S. are spending money. This criticism overlooks one of the key drivers of China’s high savings rate; it’s very hard to consume your capital when you are fundamentally pessimistic about the future.

One of the strange things about indeterminate optimism is it has the low investment and low savings

Substance vs. Process

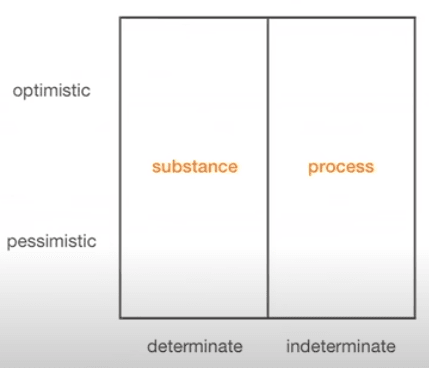

Another way to look at the determinate vs. indeterminate question is through the lens of substance vs. process. What people do and what technology they build will depend on how they view the future. From an indeterminate perspective, they won’t know what to build. There’s nothing that specifically looks promising; it’s all just a distribution. So they will think less substantively and more procedurally.

In determinate world, you focus on specific substance and indeterminate world you end up focusing on processes. Whats the process of doing things.

How each quadrant shakes out in practice looks something like this:

- Optimistic, determinate: Engineering and art. Very specific engagements.

- Optimistic, indeterminate: Law and finance.

- These are the kind of process oriented disciplines you pursue when you have no idea about the future but the piping of the system works and but you sort have sense that system just works automatically.

- Law is a process of applying specific rules, not a certain substantive result. You assume that by following the process you end up making things better. And finance is pretty thoroughly statistical.

- Pessimistic, indeterminate: Insurance.

- You can’t make money but you can protect against expected losses.

- Pessimistic, determinate: Wartime rationing.

Definite Optimism : Some classic examples from US history

- Transcontinental railroad, this was a huge work and they did it.

- Robert Moses - Comes with bulldozer leveled neighbour hoods, Built parks, roadways. It sort of stopped in 1960s

- In 1950s, Big civil engineering projects designed by School teacher in san francisco there congressional meetings for this. Somehow it was stopped.

- All classic science fiction visions : Cities underwater, moon, mars and in space they were very definite ideas of future. Today if you look at this, they sort of look past or fiction. But 50years back they believed that its possible.

Indefinite Optimism : Finance

- Portfolio investing theory - You should invest in the stock market index.

- Strange thing in this shift from definite to indefinite views of the future is the engineering to finance one of the things that happen is money becomes important.

- Money is king and its gets accumulated

Natural drift is from finance to insurance, this is no anti-buffett thing but buffett was ahead of the curve and used the opportunity. Indefinite pessimism world is dominated by insurance.

In Indefinite Optimism world, you can’t know anything substantive about any specific business. But it’s still optimistic; finance doesn’t work if you’re pessimistic. You have to assume you’re going to make money. Indefinite optimism can be really strange. Think about what happens when someone in Silicon Valley builds a successful company and sells it. What do the founders do with that money? Under indefinite optimism, it unfolds like this:

- Founder doesn’t know what to do with the money. Gives it to large bank.

- Bank doesn’t know what to do with the money. Gives it to portfolio of institutional investors in order to diversify.

- Institutional investors don’t know what to do with money. Give it to portfolio of stocks in order to diversify.

- Companies are told that they are evaluated on whether they generate money. So they try to generate free cash flows. If and when they do, the money goes back to investor on the top. And so on.

What’s odd about this dynamic is that, at all stages, no one ever knows what to do with the money. Money plays a much more important role if the future is indefinite. There, having is always better than specific things. It’s pure optionality, and that optionality encapsulates the indefinite view. In a definite future, by contrast, money is simply a means to an end.

The era of indefinite optimism is arguably coming to an end. Look at government bonds, which are essentially the purest version of money. Yields keep going down. People keep holding because they don’t know what else to do. Today you can earn 1.8% on a government bond. But expected inflation is 2.1%. The expected return over the next decade is -0.3%. You get negative returns when people run out of ideas.

In an indefinite world, investors will value secret plans at zero. But in a determinate world, robustness of the secret plan is one of the most important metrics. Any company with a good secret plan will always be undervalued in a world where nobody believes in secrets and nobody believes in plans. The ability to execute against long-term secret plan is thus incredibly powerful and important.

Indefinite : Politics

If you think that the future is indeterminate, the most important people are statisticians. Pollsters become more important than politicians. There has been a massive upward trend on polling in the last 30 years. We have polls on everything. And we believe them to be authoritative—it’s dangerous to try and outthink a statistically shifting bloc of voters. Unsurprisingly, then, politicians react to the polls instead of thinking about the future. This helps explain the strange mystery in 2008 of why John McCain picked Sarah Palin as a running mate. The McCain people reviewed all the polls about Republican governors and senators. Most were very unpopular. Palin, by contrast, had an 89% approval rating in Alaska. Just parsing poll data, Palin was the obvious choice. That didn’t work out quite as well as they expected. This has nothing to do with Palin’s merits as a candidate; it just goes to show how statistical poll data, and not clear thinking, can dominate politics. Taking a principled stand on unpopular positions is not what our leaders are incented to do.

Think on, what the government actually does has changed radically. In the past, the government would get behind specific ideas and execute them. Think the space program. Today, the government doesn’t do as many specific things. Mainly it just shifts money around from some people to other people. What do you do about poverty? Well, we don’t know. So let’s just give people money, hope it helps, and let them figure it out. If you can’t actually know what to do, just spreading money around is all you’ve got.

Zero to One

Most engineering fields are bad fields to go in the western world in the last 40-50 years mechanical engineer, chemical engineer, electrical engineer that was down in 1980s itself, astro engineer is a bad idea in last 40-50 years.

From 1970s there's been not much progress outside of computers in US.

- iPhone seems to distract us from knowing that subway is 100 yrs old.

- Cars, houses changed little bit but not that much progressed in 20-30 years.

- Questions on progress of science never gets asked, if it get asked, we get nothing more than short propagandistic answers from University presidents using adverbs as a substitute for thought that clearly and demonstrable science is progressing faster.

- How fast is it progressing

- Is it accelerating

- Is it deaccelerating

- Is it relatively stagnant

Big science is something like a oxymoron, when you make it big it stops being science. We have 100 times more people in world and US, who have PHDs in sciences compared to 1920. Can you say productivity of scientists is 99% less now.

If you have a imaginary conversation with baby boomer cancer researcher first thing is

- we are making so much progress, we are going to cure cancer in next 5 years. That’s what they been telling for last 50 years.

- We don't have enough money, we don't have enough money. Have you been responsible with money you have been getting it for 50 years.

- Third line of defense is, its an impossible problem, we are doing the best we can.

These are natural excuses made by generation of scientists who have failed to do things, we have to take the contrarian view, its stagnant, it is not about the money and it’s the culture and therefore these things could be fixed.

- Integrity of process is something that nobody can ask like Professor Laughlin Nobel prize winner in 90s, questioned Stanford biology department that they are doing semi-fraudulent research and stealing money from government and eventually he got defunded.

Replicability crisis - Experiments that cannot be replicated again. 80% of psychology results cannot be replicated. If something is science then its experiments should be able to be replicated.

Some of these are pretty corrupt systems.

In Christianity,

Generally we need good role models, for Christians, only role model is Christ and all other role models lead to inner personal conflicts

If you go to old testament, 10 commandants, I often think, two most important ones are first and last

- First one, you should only worship god, you should look up to the one true god

- Tenth one is, you should not look around at your neighbors should not covet the things that belong to your neighbor and when you know when you do not have a transcendent religious belief, you just end up looking around other people. I think that is sort of problem with the atheist liberal world, its just madness of crowds.

Medieval's believed in the weakness of the will and power of the intellect and moderns believe power of the will but the weakness of the intellect.

If you are too focused on your enemies, rivals and competition it becomes very hard to form a team that’s gonna work on some transcendent goal or transcendent purpose

If you categorize on medieval Catholicism, you always debate on which ones are worse, officially pride is suppose to the worst. According to me, envy is the one mortal sin that is completely taboo all other thing can be turned into something positive. Greed is good Gordon Gekko or whatever. There is a way to flip all others around, envy is something we still don't talk about and its sort of pervasive and destructive.

Competition is for Losers 2014

Entrepreneurs always have to aim for monopoly, competition is for losers.

There are two kinds of businesses in the world, businesses that are highly competitive and other is monopoly. People will constantly lie about the nature of business they are in. People who are in monopolies pretend not to, they will say they are in incredible competition. On the other end, competitive businesses never make any money, you will tell lie like you are doing something unique, somehow its less competitive than it looks because you want to attract capital.

- Non-monopolies - we are in a narrow market

- Monopolies - we are in a huge market

Brand is a slippery concept, I dont invest in branded companies. I invest in companies that has technological advantages

Google is it a monopoly ?

- In the search, it has 66.4% market share. By looking at this you can say google is a monopoly in search market. But google, currently doesn't describe itself as search engine these days.

- It said it’s a advertising company, may be just to make it look like a smaller company. Percentage wise they market share is less when you compare to search.

- In advertising market, US Search advertising is $17B

- US online advertising is $37B

- US advertising is $150B

- Global advertising is $495B

- If you say, it’s a technology company, global consumer technology market is $964B, they can say

- We are competing with MS with office products

- We are competing with all car companies with self driving cars

- We are competing with apple on TVs and iPhones

- We are competing with FB

- We are competing with Amazon with cloud services.

We are giant technology market where competition is in every direction and we are not monopoly that government is looking for and we should not be regulated in anyway whatsoever.

Monopoly businesses will have huge cashflow and higher gross margins, they don't know what to do with their money.

How to start monopoly

Start small and monopolize

- Its easier to dominate a small market than a large one

- If you think your initial market might be too big, it almost certainly is

- Amazon started as a book store and later expanded to other ecommerce products.

- People often think these companies are not valuable at the beginning.

- Clean tech companies started in 2005, they started big and they shrink.

Characteristics of monopoly

- Proprietary technology - unique businesses

- Network effects

- Economies of scale - Very high fixed costs, very low marginal costs, high adoption rate

- Branding

You want to be last mover or the company that made the last breakthrough or you should be able to say why yours will the last breakthrough for a long time or you can make quick improvements that no one else can catch up.

For example,

- There were search engines before google, but they were the ones who came up with PageRank algorithm and automated approach.

- Facebook is not the first social networking site, in fact in 1997 there was a website call socialnet(by Reid Hoffman), but facebook is the one that gave identities.

Faster adoption is critical to capturing and taking over markets because even if you have small markets and adoption rate is slow there will be enough time for other people to enter the market and compete with you. Idea is small-mid size market with fast adoption rate. This is why silicon valley has done so well.

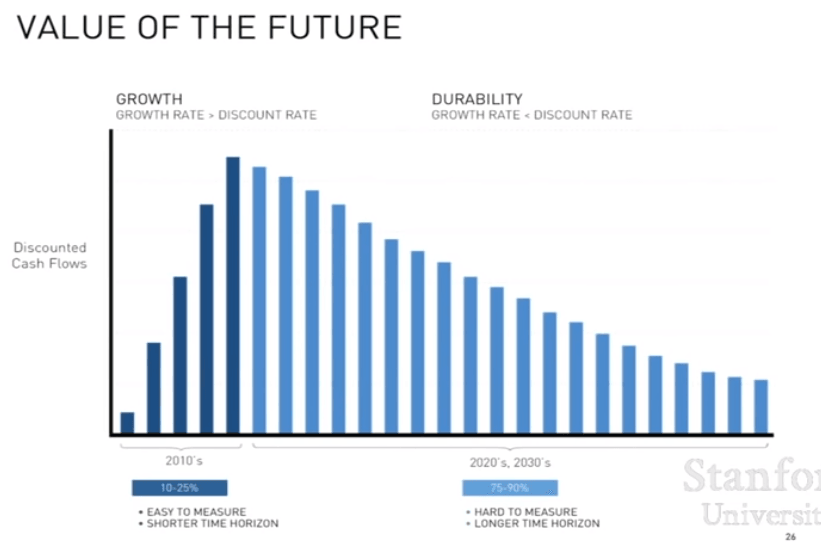

One of the idea of last mover is that value of these companies exists far in the future. Growth rate is much higher than discounted rate.

- Microsoft was the last operating system for many decades

- Google is the last search engine

- Fb will be last social networking site

Cashflows of tech companies will come in the future not in the present, that’s why the growth rate is important as you don’t know whether they will exist in 10 years. They have to durable.

A business creates X dollars of value and captures Y% of X.

Here X and Y are independent variables

You have to question yourself that "Does this tournament always makes sense as you keep going ?" When you are competing with people around you like students from Stanford may feel like they have machine guns and others with bow and arrow (or) junior high school and high school.

Battles were so ferocious as the stakes were so small

-- Henry Kissinger(Harvard)

So much of people identities got wrapped up in winning these competitions that they somehow lost sight of what was important what was valuable you know competition does make you better at whatever it is that you are competing on.

"don't always go through the tiny little doors that everyone tries to rush through, maybe go around the corner, go through the vast gate no one is taking" -- Peter Thiel

- People always overvalue what they do well. There is this bais, they overvalue what they are good at and undervalue everybody else.

- Bad plan is better than no plan.

- Lets figure out as we go along is a bad idea

Peter Thiels view on Christianity and approach towards future

Three simple statements will lead us towards our ultimate answer:

- Don’t copy your neighbors

- Time moves forward

- The future will be different from the present

To understand Thiel’s ideas, we need to begin with the person who influenced Peter Thiel more than any other writer: Rene Girard. Rene Girard was a French historian and literary critic. He’s famous for Mimetic Theory, which forms the bedrock of Thiel’s worldview. Thiel studied under Girard as an undergraduate at Stanford in the late 1980s.

Competition distracts us from things that are more important, meaningful, or valuable. We buy things we don’t need with money we don’t have to impress people we don’t like. Trapped in a never-ending rat race, lawyers climbed the corporate ladder by winning favor with partners at the top. Others engaged in small acts of sabotage against their coworkers. Law school was worse. Like lobsters in a bucket, wannabe lawyers battled for law school placement and law firm employment. Each goal led to the next. Rather than focusing their attention on the end goal of developing a legal expertise, transforming the Constitution, or rescuing the powerless from tyrannical injustice, they elbowed their peers so they could score higher than their classmates on standardized tests. The competition was zero-sum. The better one student did, the worse their peers scored.

Section 1: Don’t Copy Your Neighbors

Everybody imitates. We cannot resist Mimetic contagion, and that will never change. But there are bad ways to copy and good ways to copy. Bad imitators follow the crowd and mirror false idols, while good imitators copy a transcendent goal or figure.

Imitation draws people together. Then, it pulls them apart like an ocean riptide.

At first, two people who share the same desire will be united by it. But if they cannot share what they both desire, their relationship will transform. They’ll turn from the best of friends to the worst of enemies. Conventional wisdom says that we loathe people who are nothing like us. But when it comes to envy, jealousy, and resentment Girard takes a different perspective. Since small disagreements loom large in the imagination, Girard wrote that social differences and rigid hierarchies maintain peace. When those differences collapse, the infectious spread of violence accelerates. The fiercest rivalries emerge not between people who are different, but people who are the same. The more two people share the same desires, the greater the risk of Mimetic competition.

Similar people are most prone to Mimetic envy because we tend to compete for status with the people who are closest to us. When two people are different and far away from each other, the tension will stay calm. Thus, the more we resemble our peers, the more Mimetic conflict will arise.

Girard observed that even when you put a group of kids together in a room full of toys, they’ll inevitably desire the same toy instead of finding their own toy to play with. A rivalry will emerge. Human see, human want. Our capacity for imitation leads to envy. Babies’ interest in a particular toy has less to do with the toy itself and more to do with the fact that the other babies desire the toy. As soon as one child desires the toy, so do the others. Eventually, even though there are many toys available to play with, all the children want the same toy.

Competitive strategy in business

Michael Porter’s philosophy of business strategy. Porter is a Harvard Business School professor known for his theories on economics and business strategy. He believed that strong businesses aim to be unique, not the best. Trying to outcompete rivals leads to mediocre performance, so companies should avoid competition and seek to create value instead of beating rivals.

As Thiel once wrote:

“Once you have many people doing something, you have lots of competition and little differentiation. You, generally, never want to be part of a popular trend… So I think trends are often things to avoid. What I prefer over trends is a sense of mission. That you are working on a unique problem that people are not solving elsewhere.”

We analogize business to war. In war, victory requires that the enemy is crippled or destroyed. Rivals who pursue the “one best way” to compete will converge on a collision course, where everybody listens to the same advice and pursues the same strategies, leading to zero-sum outcomes where total industry profits fall towards nothing. When you compete to be the best, you imitate.

When you compete to be unique, you innovate. In business, multiple winners can thrive and coexist. You don’t have to annihilate your competition. While imitation creates a race to the bottom, innovation promotes healthy competition and economic growth. In that way, business is like the performing arts, not war. In the performing arts there are many entertaining singers and actors, each with a distinct style. The more talented and differentiated performers there are, the more the arts flourish. This is the essence of positive-sum competition.

High profits attract competition. According to economic theory, if outside entrepreneurs hear about profits, they’ll start a new firm and enter the industry. Increased supply will drive prices down, which will decrease total industry profits. If too many firms enter the market, the entire industry will suffer losses. If companies start to lose money, they’ll go out of business until industry prices rise back to sustainable levels. Most importantly, in a world of perfect competition, no company will make an economic profit in the long run. Just like the airline industry.

Thiel offers an alternative to perfect competition: monopoly. Without competition, they can produce at the quantity and price combination that maximizes their profits. Successful strategies attract imitators, so the best businesses are difficult to copy. Firms in a competitive industry who sell a commodity product cannot turn a profit. But companies who have a monopoly can set their own prices since they offer an in-demand product that cannot be replicated. Monopoly firms are big fish in a small pond.

Section 2: Time Moves Forward

Keller quoted Robert Nisbet, the author of The History of the Idea of Progress. In it, Nisbet argues that ancient people saw time as cyclical, and no idea has been more important to Western Civilization than the idea of progress.

The Ancients assumed that humanity was doomed to cycles of pessimism. Even if they held ideas of moral, spiritual, and material improvement, the idea that humanity can improve itself, step-by-step and stage-by-stage into an earthly paradise is uniquely Western. Christian theology sees time as linear. It moves away from the Garden of Eden, and toward a day of judgement, justice, and the establishment of a divine, peace-filled kingdom.

To Peter Thiel, short-term thinking is the essence of sin. Like The Bible, he advises us to make plans and sacrifice the present for the future. Greatness is like chess. To win, you must study the end game and work towards the one you want to see. Thiel’s favorite chess player was José Raúl Capablanca who said: “To begin you must study the end. You don’t want to be the first to act, you want to be the last man standing.”

Thiel says a bad plan is better than no plan at all. Having no plan is chaotic. He supports people who trade the shiny mirage of short-termism for the calm, controlled grace of a long time horizon. Like Capablanca, they are the kinds of people who study the end-game and work backwards from there.

Thiel concludes that time is linear, not cyclical. The future won’t look like the present. It will either be much worse or much better. Or more explicitly, “stagnation leads straight to apocalypse.” If we don’t, we’ll suffer from limitless Mimetic violence; and if things go well, we might find our place in God’s peaceful kingdom.

Section 3: The Future will Be Different From the Present

“And I saw a new heaven and a new earth: for the first heaven and the first earth were passed away; and there was no more sea.” —— Revelation 21:1

The Book of Revelation paints two outcomes for the future of humanity: catastrophic apocalypse or a new heaven and a new earth. Some of the Christians I know believe that humans aren’t literally taken out of this world and transported into heaven. Instead, as explained in Revelations 21, heaven comes down to earth. According to this vision, humanity will be cleansed, renewed and perfected. The horrors of the world will be undone. People will receive the lives they’ve always wanted. All evils will be repaired, and the pain of existence will vanish like evaporating water after a thunderstorm. Better yet, the joy and glory of a world after redemption will be greater because humans have suffered to reach it.

Thiel fears that due to technologies like nuclear weapons, humans are already capable of destroying the world. With modern technology, a tiny number of people are capable of inflicting unprecedented levels of damage and death with the push of a single button. That though, doesn’t mean we should stop innovating. A lack of progress leads straight to a bleak, ravaged, and apocalyptic world.

“The cliche goes like this; live each day as if it were your last. The best way to take this advice is to do exactly the opposite: live each day as if you would live forever.” —— Peter Thiel

Thiel encourages us to be specific about the long-term future we want to create. Here, he counters the secular and Eastern philosophy. Under the secular mindset, there is no transcendent future after death. This is it. You have one life. Similarly, according to Eastern religions, we lose our individuality and lose our material lives so we can become part of the whole again. But Christianity offers a different perspective: work for the fruits of eternity instead of chasing the fleeting pleasures of the day. Don’t place too much weight on the present moment. Instead of focusing on meaningless scandals, endless political dramas, or the limitless accumulation of wealth, we should focus on the impending catastrophe at the end of the road. Work to prevent runaway Girardian violence. That way, when the Day of Judgement comes, we’ll lean towards the side of the good.

The end of the future

Since the Financial Crisis, tens of thousands of Americans have moved into the Indefinite Optimism and Definite Pessimism quadrants.

According to Thiel, this shift has been worse than acknowledged. A 2011 essay called The End of the Future, which lives on the homepage of the website of his venture capital firm, argues that progress has stagnated.

- We’ve shifted away from funding transformational companies and toward companies that solve incremental problems, and sometimes even fake ones

- Thiel has himself invested in Palantir and DeepMind and also in Airbnb, Stripe, and Postmates.

- We’ve narrowed the definition of technology from space, airplanes, and rockets to Angry Birds and SnapChat filters.

- America’s imagination peaked in 1969, when Neil Armstrong stepped foot on the moon. President John F. Kennedy’s speech at Rice University where he said: “We choose to go to the moon, not because it’s easy, but because it’s hard.”

- The rate of technological progress is slowing. The only major exceptions are semiconductors, DNA sequencing, and communications technology.

- We’ve lowered our efficiency standards. The Golden Gate Bridge was built in less than four years in the 1930s. The recently completed Golden Gate Bridge access road, Doyle Drive, took seven years to build and cost more in real dollars than the original bridge. Buildings, too. The Empire State Building was built in 15 months from 1931-1932. 80 years later, The Freedom Tower took more than 12 years to build.

- Millennials are less well off than members of earlier generations were when they were young. They have lower earnings, fewer assets, and less wealth. Children born in 1940 had a 90% chance of earning more than their parents. But children born in the 1980s have only a 50% chance. Christoper Kurz, an economist at the Federal Reserve has shown that millennial households had an average net worth of about $92,000 in 2016, nearly 40% less than Gen X households in 2001, adjusted for inflation, and about 20% less than baby boomer households in 1989. Wages tell a similar story. In short, millennials have it tough and it isn’t their fault.

- With the rise of dystopian films, Hollywood creates and reflects these dark predictions about the future.

- There is also rise of dystopian films, Hollywood creates and reflects these dark predictions about the future.

- The most talented people follow the same narrow tracks. People are afraid to dream big or stand out.

If everyone is thinking alike, then no one is thinking. -- Benjamin Franklin

“If you’re in the US and go to a good school, there are a lot of forces that will push you towards following train tracks laid by others rather than charting a course yourself. Make sure that the things you’re pursuing are weird things that you want to pursue, not whatever the standard path is. Heuristic: do your friends at school think your path is a bit strange? If not, maybe it’s too normal.” -- Patrick Collison, the CEO of Stripe

The top colleges have become vocational schools for investment banking and management consulting. In 2007, for example, half of Harvard seniors took jobs in finance or consulting. This mirrors my own experience. My college jobs department steered us towards high-status jobs instead of high-impact ones. Students, professors, and advisors cared more about perception than reality. It felt as if the goal of life wasn’t to improve the world, but to win awards and build an impressive resume. Instead, my smartest friends were pushed towards a handful of fields: law, management consulting, and investment banking.

In an essay called The Trouble with Optionality Harvard professor Mihir Desai worries that the language of finance has polluted life. He condemns the modern, finance-fueled affair with optionality. Rather than taking risks or working on important projects, students acquire options. In finance, when you hold an option and the world moves with you, you enjoy the benefits; when the world moves against you, your downside risk is protected and you don’t have to do anything. The more optionality, the better. Picking a path reduces optionality, so people stay in limbo and don’t make commitments. This language doesn’t only apply to career planning. Some students talk about marriage as the death of optionality. But life is not like options trading.

“The shortest distance between two points is reliably a straight line. If your dreams are apparent to you, pursue them. Creating optionality and buying lottery tickets are not weigh stations on the road to pursuing your dreamy outcomes. They are dangerous diversions that will change you.” -- Mihir Desai, Harvard professor

We lack courage, not genius. We’re swimming in money, but starving for ambition. Every venture capitalist I meet says there’s too much money and not enough good ideas.

Promise of hope

Our spirits rise when hopes are high. That’s why the day before Christmas is as exhilarating as Christmas Day. Big, bright gifts sit under the tree. Smaller ones hang in firetruck-red socks over the living room fireplace. Children play. Parents cook. Grandparents tell stories. And the rush of anticipation releases everybody’s serotonin.

Likewise, everybody knows that a team with belief is hard to beat. But a team that doesn’t believe they can win is hopeless. The importance of belief and momentum is evident to any shouting fan in any arena across the country. And yet, few consider its importance at the societal level.

Hope enables believers to endure unimaginable suffering. A hope so resilient that like a Captain America’s shield, it can survive any evil, any sickness, or any torture. No matter the obstacles, certainty about the future gives you the confidence to act in the present.

Peter Thiel’s Advice

Peter Thiel with Christian inspired foundations has three principles

1. SEARCH FOR SECRETS - Create a positive vision for the future

“It is the glory of God to conceal a matter; to search out a matter is the glory of kings.” —— Proverbs 25:2

Thiel opposes the idea that luck is all-powerful. He encourages human agency and believes in the power of a single individual to bend the future to their will. Thiel believes we attribute too much to luck, which stops us from actually doing things. As he proclaimed, “you are not a lottery ticket… you can either dispassionately accept the universe for what it is, or put your dent in it, but not both.”

2. Be careful who you copy

“Then I saw that all toil and all skill in work come from a man’s envy of his neighbor. This also is vanity and a striving after wind.” —— Ecclesiastes 4:4

Even if imitation is inevitable, we can reduce the negative effects of it. We can avoid the kinds of competition that lead to violence. If Girard is right, we are not as individualistic as we think we are. If we must copy others, we should be careful who we copy.

Thiel encourages people to ask themselves: “How do I become less competitive in order that I can become more successful?”

3. Follow the Ten Commandments

"I am the lord, your god." —— 1st Commandment

The first commandment says that we should only look to God. There is only one God and you should worship him. Look up, not around. Follow The Bible, which says there is no salvation in anyone other than Jesus. You won’t figure out what to do by looking at your peers, so don’t copy the people around you. Instead, we’ll end up in copycat rivalries where we claw and fight with each other like crabs in a bucket.

Guided by the Cain and Abel story, remember the danger of imitating the wrong person. At first, it can inspire cooperation. But over time, it leads to envy, violence, and the apocalypse.

“Thou shalt not covet your neighbor’s goods.” —— 10th Commandment

The last commandment says you shouldn’t covet your neighbor’s goods. Inspired by the 10th commandment, Thiel encourages listeners to avoid competition. True to Mimetic Theory, the last commandment focuses on the neighbor instead of the object of desire because all objects are desirable when they belong to your neighbor. Society will push you towards competition, but you shouldn’t compete with your peers or depend on them for guidance. Competition is for losers. Instead of looking to the people around you for answers, find models that you cannot compete with. If you’re Christian, follow Jesus, and if you’re not, follow an intellectual hero who is way ahead of you. Rather than using your peers as a reference point, find your own transcendent orientation.