The Art of Investing, Talks at Google, François Rochon

— nfwyt, quest-for-wealth — 3 min read

It is the long-term investor who will, in practice, come in for most criticism. It is in the essence of his behavior that he should be eccentric, rash and unconventional in the eyes of average opinion.

- The state of long-term expectation(1936), John Maynard Keynes

How to NOT Beat the market

- Think the same way within same time horizon as other investors

- Own lots of companies so you dont differ much from average

- Believe you are smarter than others and can predict the market.

Stock selection process

- Financial Strength: ROE > 15%, EPS Growth> 10%, Debt profit ratio <4x

- Business Model: Market Leader, High wide and deep Moat, Low Cycylicality

- Management Team: High level of ownership from CEO and CFO, constructive acquistions, Good capital allocations.

- Market Valuation: 5 years valuation model, Try to purchase at half the estimated value in 5 years (double money in 5 years, Around 15% annual return)

Investment & Beauty

- Art and beauty are inter related.

- How do you define beauty investment.

- We find something beautiful when its rare

- And something unique is the rarest of all

Unique creates a wide and deep moat.

What we look for in a company is 3 things

Market valuation comprises of these 3 circles,

- Financial strength (science part)

- Management (judgement rationality)

- Competitive advantage (art part)

When we overlap all these there are just 125 stocks.

Example: Walt Disney - Owners of unique characters. Mickey Mouse has 3 great qualities: Popularities, immortality and no agent. Keep making Alice in wonderful and jungle book like movies animation. Like you take oil from oil field and come back few years later and full of oil again.

Example: carmax: PE ratio was 24 x in 2007 and 14 x later in 2014 etc. Athough PE ratio has gone down stock has done better. Done better than SPX.

Competitive advantage as investors is Patience, Humility and rationality

- Humility means

- We are not smarter than market, cannot predict macro economic events.

- Define your circle of competence (it is the boundary and not the size that matters).

- Recognize mistakes, learn from them for future investments.

Timing of purchases: 80% of success is showing up -Woody Allen

- Rationality

- Dont get affected when others make money than you.

- Impervious to stock market quotations in short term.

- Accept we dont know the future and focus on what we have control (Our own process, companies that you understand and believe and own companies with great mangers).

The Rule of 3

If you accept these rules, it will help you prepare psychologically,

- One year out of 3 stock market will decline 10 % or more

- One out 3 stocks will not perform as expected.

- One year out of 3, we wil underperform the index.

"Patience is not ability to wait by keeping a good attitude while waiting." Patience is neither denial nor stubborness. so we try not to get cooked like a frog in boiling water (when temperature is gradually increased).

When stock prices are falling, earnings start to deteriorate, debts are increasing see what's happening to the company that's what is happening to the stock. Just because you like the company don't stay in it.

Good attitude is to focus on what is happening to company(earning improving) and not worry about stock price.

Earnings: In case of Carmax; 2007-17 Over 10 years EPS grew 352% ad and Compund annual growth rate CAGR grew 16 %.

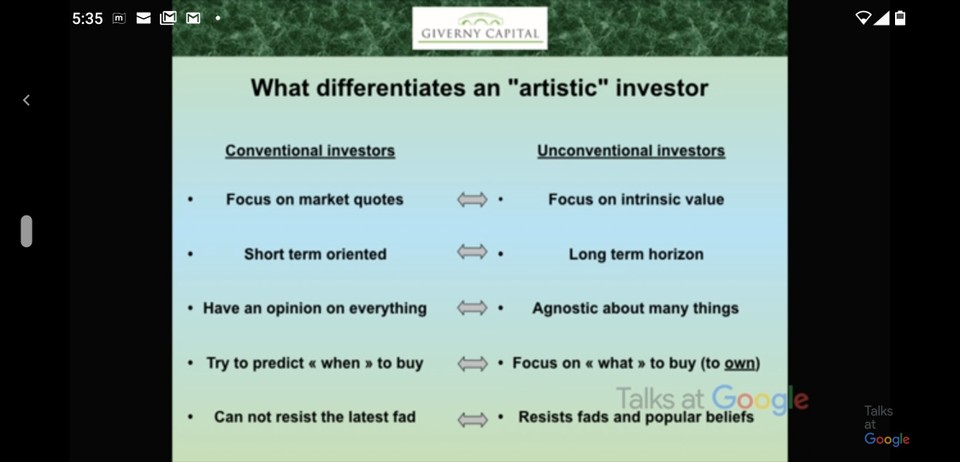

What differentiate an artistic investor from the conventional investor,

A wise investor must be able to balance the inherent dualities in many human activites

- Love of the art but you shouldn't fall in love with stocks, you should be rational

- You should have very large fields of knowledge to look at many many companies but at the same time Focus on circle competence

- You want to be Open-minded but at the same time you have to have Independence of thoughts

- You want to be able to Value the business but at the same time you should be able to go beyond numbers

- You have to have Patience but at the same time Don't get cooked like frog

- You should have Discipline but you should be able to break the rules. Discipline is to follow your own rules, but wisdom is to know when to break the rules.

What do we do differently at Giverny Capital?

- We think independently

- We own a few selected companies

- We have a very long time horizon

- We try to develop the right behaviors ( rationality, humility, patience )