Investing the Templeton way, Talks at google, Lauren Templeton

— nfwyt, quest-for-wealth — 1 min read

Quotes from Sir John Templeton

"PEOPLE ARE ALWAYS ASKING ME where the outlook is good, but that's the wrong question. The right question is: "'Where is the outlook most miserable?"

"lf you want to have a better performance than the crowd, you must do things differently from the crowd."

"Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell."

"MAJOR CAUSE OF HIGHER PRICES is higher prices; but when the trend is reversed, then lower prices lead to still lower prices. To buy when others are despondently selling and to sell when others are avidly buying requires the greatest fortitude and pays the greatest ultimate rewards."

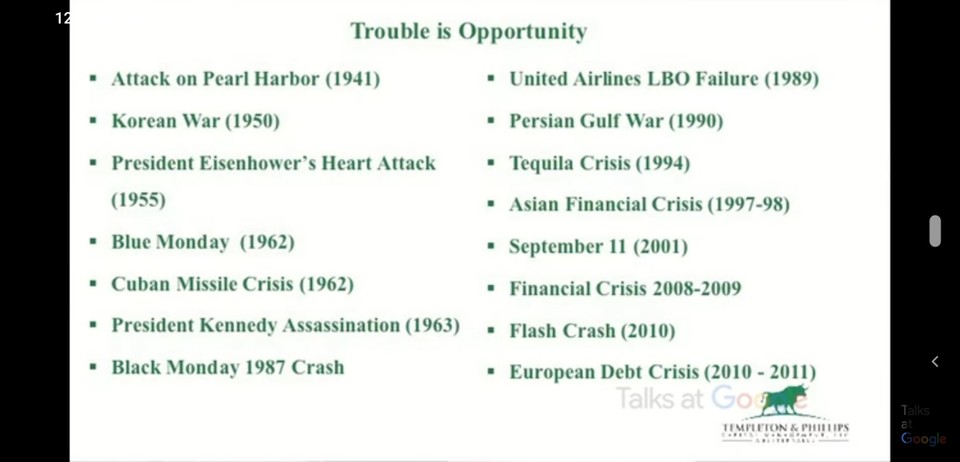

Trouble is opportunity

Tech Bubble : Insiders of the tech companies knew the companies were overvalued. Thing is there is this IPO lockup they cannot sell.

- Since 1900 there has been 125 corrections and 35 bear markets. Corrections come almost every year and best market every 3-4 years.

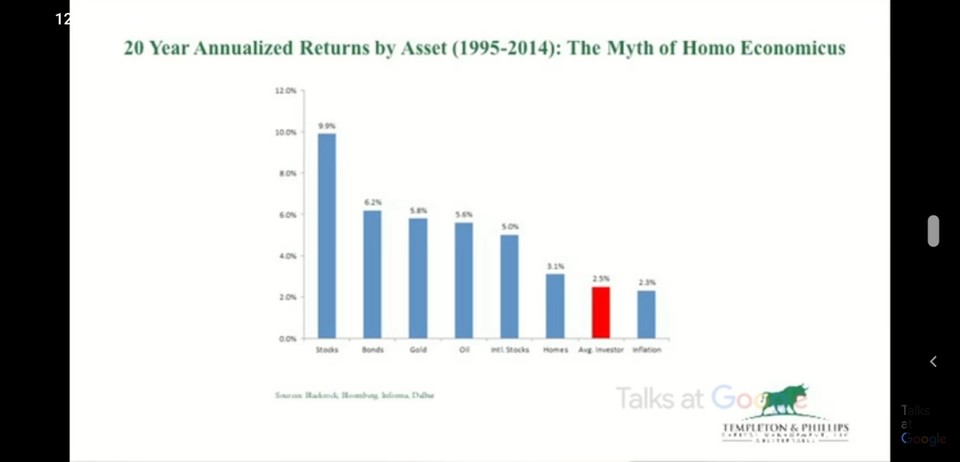

- Average investors make 3.5% . Often they do is buy high sell low.

- Mutual funds are terrible vehicle for managers as investors give money at wrong time and take out money at wrong time. So difficult to manage.

- Don't confuse genius with the bull market

- Marshmallow test(delayed gratification kids win). Very difficult to buy at the bottom of there market.

- If you cannot control your emotion you cannot be a good investor.

- Learn to buy at maximum pessimism

- Have patience. Lots of value investors don't live in business centres.

- Have a list of undervalued stocks and buy during correction

- Tech stocks are bought during market correction (Google Alibaba)

- You have to know yourself to be a good investor

- DCF based on industry

- Do little more work than peers