Viewing stocks as bonds, Talks at Google, Donald Yacktman

— nfwyt, quest-for-wealth — 2 min read

We like to buy beach balls being underwater with water levels rising.

Investment Goals

Protect capital against:

- Permanent loss of capital

- Inflation

Grow capital by:

- Making double digit returns over time

- Exceeding the S&P 500 Index return from market peak to market peak

In order to protect capital, you need to invest, equities gives higher rates of return

Measure ourselves over a period of time that's appropriate, we feel real way to measure yourself is over a very long time period important one and we believe from one market peak to another market peak.

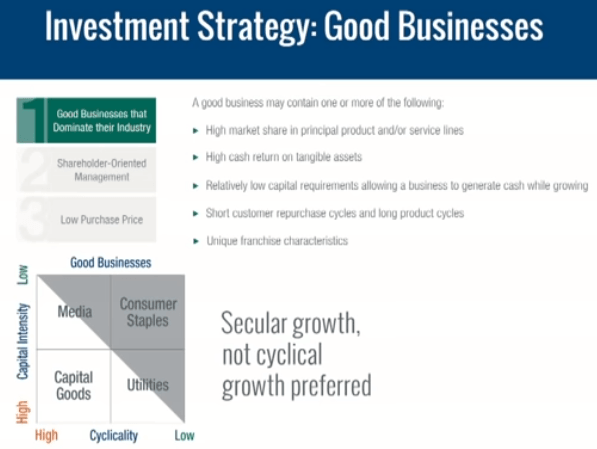

Investment Strategy: Desired Investment Attributes

- Good Businesses that Dominate the industry

- Shareholder-Oriented Management

- Low Purchase Price

Good businesses

a. Business with high ROTAs( returns on tangible assets) b. Example consumer staples, low price used on regular basis. They have edge because they can manage capital much efficiently. c. High market share and keeping the capital working you can make lots of money. d. Eg: John Deere tractor business 17 years life cycle whereas toothpaste lasts only a month. So consumers companies handle well.

- Media - Ad business, close economy and low capital

- Utilities - Only way to get ROE up because you have low ROA is to leverage it. Need to have steady cash flows. Problem during depression they will go bankrupt.

- One thing to know about investment business is, you are almost wrong always to some degree, nobody buys everything at bottom and sells everything at top. So it's a business to stay humble.

Shareholder-Oriented Management

Investment process of management of the company, when you buy equity, some part you get as dividend and other retained by management for reinvestment that's the wildcard. For long term second part is more important as it gives you more return. Management has 5 basic options on how to use the retained money,

- Put money back in business, R&D ( marketing, distribution, cost reduction, sales). Marginal ROR on new incremwntal growth is excellent. When companies have excess cash which they can't absorb, they start examining 4 other options.

- Dividends

- Sitting on cash( when you don't see opportunity sit on it )

- Acquisitions

- Buyback - Shareholders who have the stock get bigger piece of earnings

Low Purchase Price

- Nobody can't predict the future, more predictable the company is narrower the range is and less predictable wider the range is. Have biggest holding on which you have strong confidence. Element is find great businesses at low price and hold for longer periods with patience.

- It's really important to be focused and patient. There is a narrow difference between being determined and stuborn. If at the end of the day you are right you are determined. In a long horizon of time it really makes a difference and it really does separate us from so many people out there.

- There is tremendous pressure in this business for short time results and horizon time is 3 years in a underperforming market.

- High quality stocks ( AAA rated ) tend to hold better during crash, you can sell some of those to buy companies with ratings A or AA which has more upside potential. (Always have cash reserve ). This can dramatically increase your ROR.

- Lots of reasons for insiders to sell stock but only one reason to buy stock from personal money. ( Philip Morris & Carlos Slim )

- Retail is a tough business

- Amazon has a unique business

- Apple has niche business model but if there is a another product with 60-70% same feature with 2/3 of cost or half cost that's the one to go.

- Short term is the voting machine and long term is the weighing machine. 70% are moment investors they buy what is good with thrusts it's gonna be better.

- Financial stocks are low return on assets as they make money through leverage that makes them very vulnerable.

- Buy during crash, industry shortfall( 93 health care Clinton, drug and Pharma was taking a hit)

- Be protective and aggressive at the same time