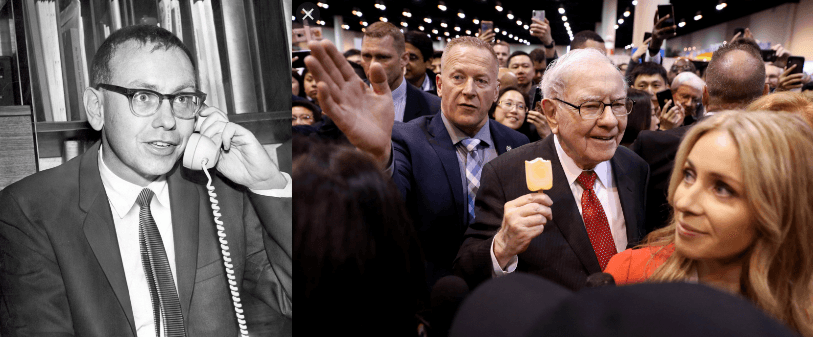

Warren Buffett

— nfwyt, quest-for-wealth — 4 min read

Last updated : 2020-02-04

# Top quotes of Warren Buffett

Don't get hung up on mistakes. Tomorrow is another day, go for the next thing.

Don't sleep walk through life.

Paint what you want. You got the brush and canvas is unlimited.

Think independently.

Be in a good environment and friends.

Defining your circle of competence is the most important thing in investing. Understand the economic characteristics of a business.

"I'm no genius. I'm smart in spots—but I stay around those spots."

—— Tom Watson Sr., Founder of IBMAssigning yourself right story and go write the story.

Public speaking & Bring the best out of people are good talents need to have.

Need to have emotional stability

Somebody once said that in looking for people to hire, you look for three qualities: integrity, intelligence, and energy. And if you don't have the first, the other two will kill you. You think about it; it's true. If you hire somebody without integrity, you really want them to be dumb and lazy.

If you were to closely follow a company, you shouldn't own it. If you buy a farm, do you go and look every couple of weeks and see how far the corn is up and you know you worry too much about whether somebody says this is a year of low prices and exports are being affected. You buy a farm and you hold it, i bought 1 farm, my son runs it but i have been there only once. It doesn't grow faster, if i go and stare at it and i can't cheer for it.

On buyback: We buy BRK shares when we have lots of excess cash and all needs of business are taken care. First would love to find other business to buy but if our stock is selling below intrinsic value, we buy our stock.

Learn to communicate better both in writing and person you can increase in value in 50%

Invest in yourself nobody can take it from you

You get one body and mind in this world start to take care of it now

Associate with people who are better than you, basically you go in direction of people who you associate with.

Be wise in choosing who you admire and who you copy, it's also important whom you choose to be partner in business and life. You want to pick a spouse little bit better than who you are and hope they don't figure it out too fast.

Greatest satisfaction is good health

When you buy a share or business think like what will come out of this business, when and how sure are you ?

A bird in the hand is two in the bush. Question is how sure are you there is two in the bush and howling you have to wait to get them out. This is 600BC that's all there to investing.

You want to stay away from any environment that stimulates activity

The best business to own, one over the extended period of time can employ large amount of incremental capital at very high rates of return. The worst business to own is one that must or will do the opposite that is consistently employ greater amount of capital at very low rates of return.

Investing is laying out money now to get more money back in the future.

When a management with a reputation for brilliance tackles a business with a reputation for poor fundamental economics, it is the reputation of the business that remains intact.

- Good jockeys will do on good horses but not on broken down nags

- Both Berkshire’s textile business and Hochschild Kohn had able and honest people running them. The same managers employed in a business with good economic characteristics would have achieved fine records. But they were never going to make any progress while running in quicksand.

Best buy time to buy assets is when it's hardest to raise money.

Intensity is the price of excellence

Buffett on Salomon issue

- To make money they didn't have, didn't need, they risked what they had and need. Thats plain foolish.

- "If you risked something that's important to you, for something unimportant to you that's just doesn't make sense" and people with top IQ made this blunder

Intellect should be the servant of the heart but not it's slave

This is a quote by 'Auguste Comte'. An author analyzes Buffett's thought process.

Buffett acknowledges that other textile businesses in the U.S. had been closing at a fast clip in the years leading to his decision, and then admits: Their owners were not privy to any information that was unknown to me; they simply processed it more objectively. I ignored Comte's advice - "the intellect should be the servant of the heart, but not its slave" -- and believed what I preferred to believe.

The more I've thought about them, the more I realize they succinctly summarize one of the key reasons why so many people get on the wrong life path, or pursue the wrong career, or simply make bad strategic decisions.

They're the literal opposite of the well-meaning but dead wrong advice that so many give: in short, "follow your passion."

However, it does seem that Buffett's "intellect" was "the slave of his heart" for 20 years, because he permitted other emotions and passions to prevent him from seeing the truth. These passions included some things that people might find laudable -- for example, a desire to keep the failing textile businesses going as long as possible, because they employed so many older workers who didn't have transferrable skills. But, they also included others, like the emotional reaction that led Buffett to buy Berkshire Hathaway to begin with, which had to do with a perceived slight from the company's former CEO (and Buffett's desire to control Berkshire in order to fire him).

Piece of Information to be desirable, it has to satisfy two criteria

- It has to be important

- It has to be knowable

-- WB said to Howard Marks

Macros are extremely important but it's not knowable. Since it's not knowable, trying to base your approach on macro is waste of time.