Wealth Is What You Don’t Spend, Morgan Housel

— nfwyt, quest-for-wealth — 4 min read

Updated on : 2020-07-01

Learning to contently live with less has the same effect as growing your income and its often easier for you to control.

Money is often a negative art.

- It has a lot to do with the actions you don’t take and things you avoid.

Everything has a price, and prices aren’t always clear.

- The price of exercise(fitness) isn’t just the workout; it’s avoiding the post-workout appetite. Same in finance. The price of building wealth isn’t just the trouble of earning money; it’s avoiding the post-earnings urge to spend what you’ve accumulated.

The trick when dealing with failure is arranging your financial life in a way that a bad investment here or missed financial goal there won't wipe you out so you can keep playing until the odds fall in your favor.

-- Morgan Housel, The Psychology of Money: Timeless lessons on wealth, greed, and happiness

Updated on : 2021-05-29

The Psychology of Money

Whenever we are surprised by something, even if we admit that we made a mistake, we say, ‘Oh I’ll never make that mistake again.’ But, in fact, what you should learn when you make a mistake because you did not anticipate something is that the world is difficult to anticipate. That’s the correct lesson to learn from surprises: that the world is surprising.

-- Daniel Kahneman

In the 1990s people were so busy trying to predict the next crash of 1987 that they missed the internet bubble.

In the 2000s people were so busy trying to predict the next internet bubble that they missed the financial crisis.

What was the biggest lesson of the 2008 financial crisis? A few popular ones I’ve heard:

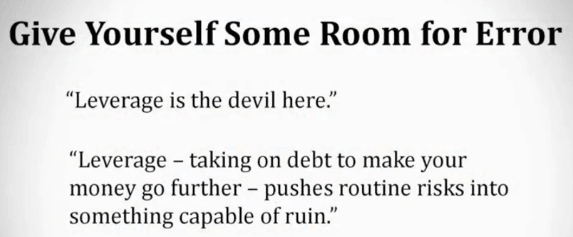

- Banks use too much leverage.

- Consumers don’t understand complicated mortgage products.

- We need more (or less) regulation on derivatives and better accounting rules.

They’re all specific to the 2008 financial crisis, and implicitly offer advice on how to avoid a future financial crisis. Which makes sense. People want to learn their lesson so they don’t fall for the same mistakes next time.

But that’s a hard way to learn a lesson. Learning specific lessons are only relevant if the next financial crisis is caused by the same thing as the last one. But it almost never is. The next recession is rarely like the last recession. The next bubble is rarely caused by the same forces as the last one. So the specific lessons we learn from each crisis may not help us avoid or navigate the next one.

Lesson from surprising is world is surprising.

Biggest risk in any given year is what nobody is talking about until it happens. It's not what's in the news, it's not trade war, it's not what we have been predicting for months, it's not election, it's not pending legislation on tax code. Biggest risk is Covid-19, Sept 9/11, Pearl harbor something that no one is talking about till moment that happened, that's gonna be the case in the future as well.

Most important story of 2021 is no one is talking about it today. Biggest news story in every year

People should save like pessimist and invest like optimist.

Meaning getting rich requires being an optimist swing for fences, take a risk. Staying rich is polar opposite requires level of pessimism, paranoia. Getting rich and staying rich are two different skills.

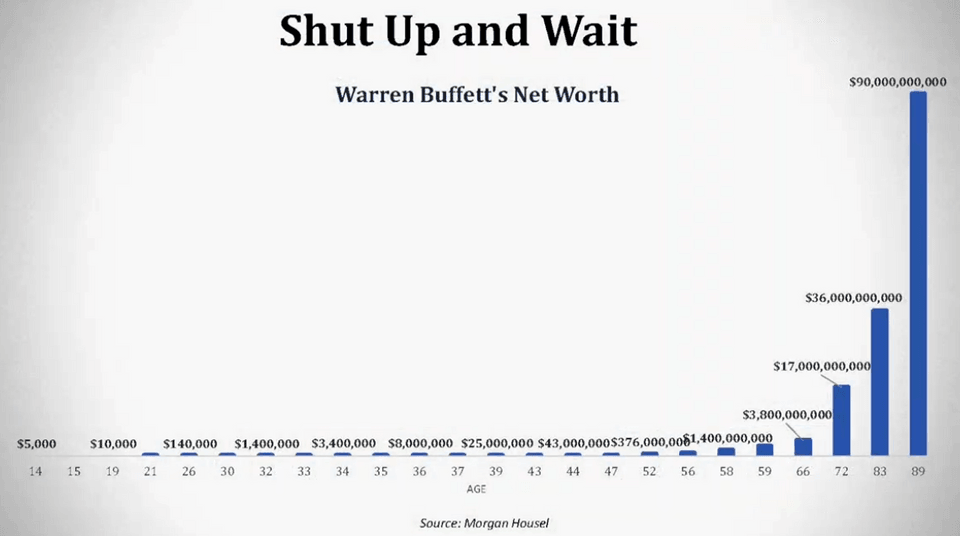

Financially unbreakable > Big returns -- If you are financially unbreakable, you might stick around to see the compounding to work in the long term. Think of your own money as barbelled. I take risks with one portion and prioritize safety with the other.

Dollar cost averaging index funds long term people might do extremely well.

Having endurance in finance really what that is being able to survive the widest range of outcomes possible. Gap between, could be from what I need to have happen and what might happen is the widest that it can be. If you have that, you are going to be able endure ups and downs so that you can compound over time. What leverage does is, it pulls that away. It lowers number of circumstances that you will be able to survive.

Warren Buffett made 97% of his money after 65yrs.

Nothings Free -- Market returns are never free, price is fear, doubt, uncertainty, regret and volatility.

Know your financial risk boundaries, there is no point in crying after going past the boundaries. Know before itself how much risk you can take. For example, look back and see how behaved in bear markets in 2001, 2008 or in March 2020 as market lost 35%. How you behaved in that time is the single best indication of future behavior.

Hardest financial skill is getting the goalpost to stop moving.

If drive to have more(money/wealth), increases your ambition faster than satisfaction and makes you feel falling behind or left behind by the world and you think only way to catch up is by taking more risk, you are falling in the trap of never ending game.

Committing to a Strategy -- There are few financial variables more correlated to performance than commitment to a strategy during its lean years. The reasonable investors who love their technically imperfect strategies have an edge, because they are more likely to stick with those strategies.

All really we want with money and wealth is independence, i want autonomy, i want to control my time, i want to spend my time with who i want, for long as i want, when i want, that to me is the highest dividend money pays. That's all i think about building wealth, how can i control time, so that i can do the work i want and i can retire when i want, i can live in the city i want to. That's what it really does for me.

-- Morgan Housel

Teaching kids about money -- The best way to teach your kids about money is to make them feel the power of its scarcity. Making sure your kids understand the scarcity of money teaches them the difference between necessary and desirable.